Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

BigONE Futures Grid FAQ

What is a futures grid?

Futures grid is an automated trading strategy. This strategy opens long and short positions within a set price range and uses price fluctuations to make profits. Futures grid has three modes: long, short and neutral. The long mode will only open long positions and close long positions, the short mode will only open short positions and close short positions, and the neutral mode will open short positions/close short positions above the market price and open long positions/close long positions below the market price.

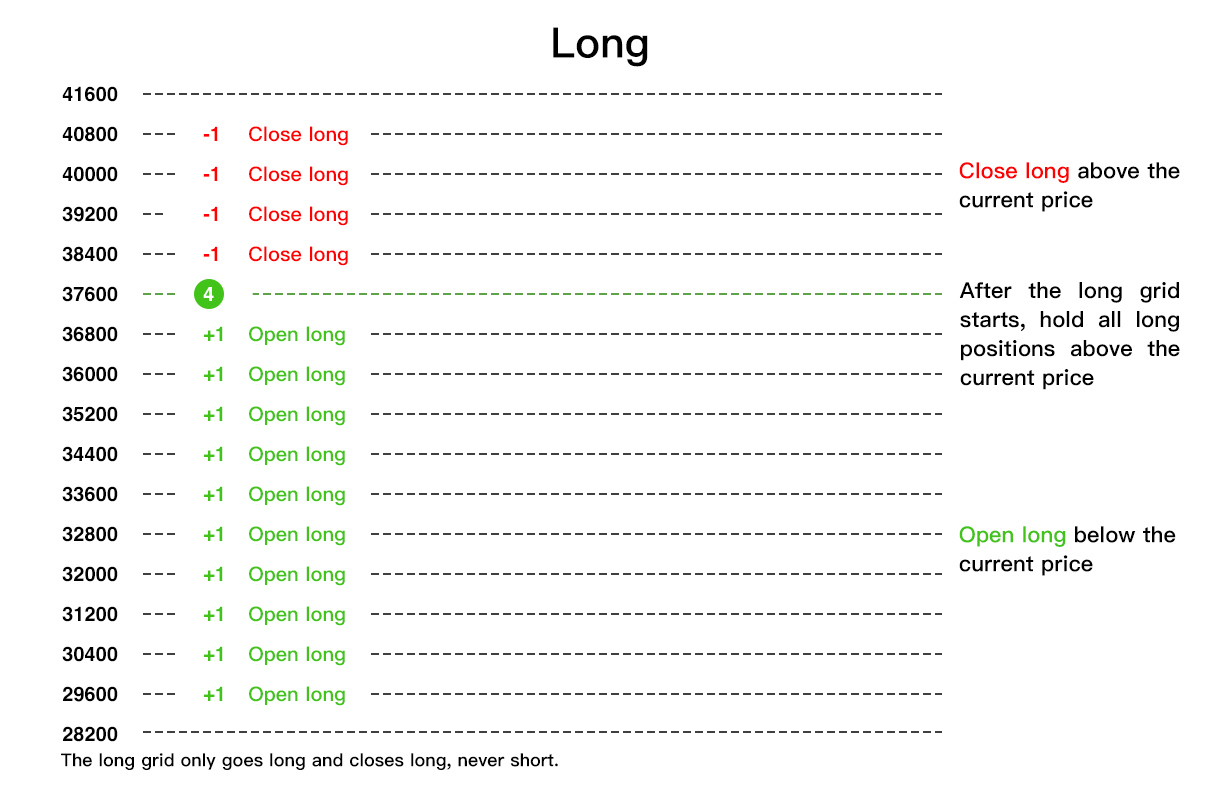

Long grid

After the long grid starts, the initial long position is held at the current price, and the initial long position = the sum of all long closing orders above the current price. Assuming that there are 4 long closing orders above the current price, the initial long position held is 4.

The program will place long orders in batches in advance below the current price and close long orders above the current price. After the price falls, long orders are executed one after another, and long orders are closed to take profit after the price rises, completing arbitrage.

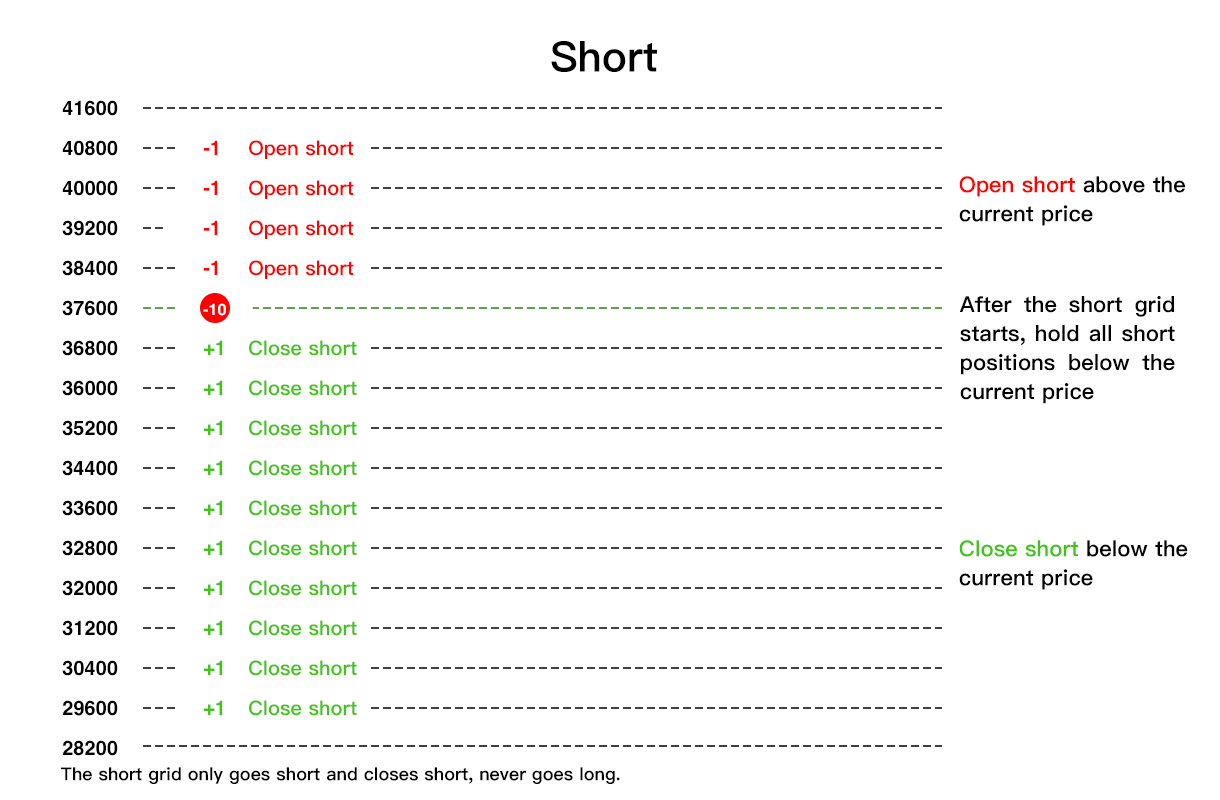

Short grid

The short grid is just the opposite. After the start, the initial short position is held at the current price, and the initial short position = the sum of all short closing orders below the current price. Assuming that there are 10 short closing orders below the current price, the initial short position is 10.

The program will open short orders in batches above the current price, and close short orders below the current price. After the price rises, short orders are executed, and after the price falls, short orders are closed to take profit, completing arbitrage.

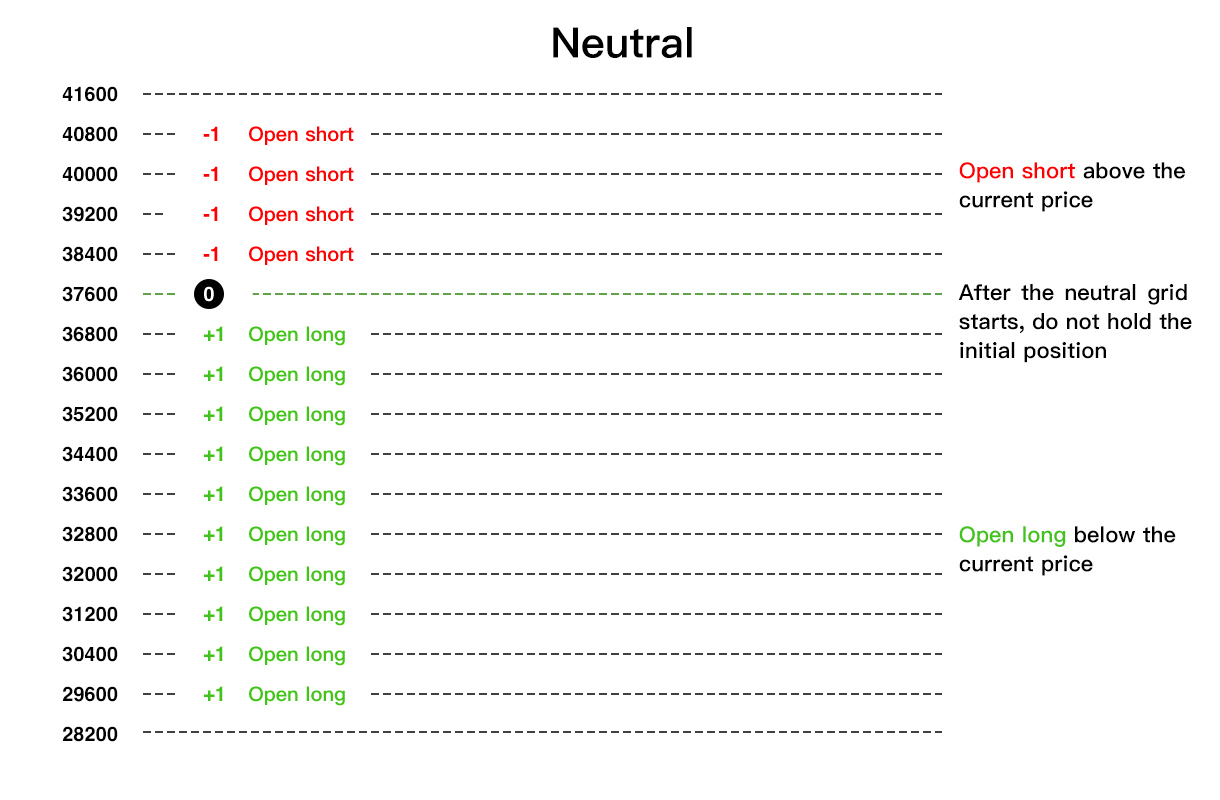

Neutral grid

After the neutral grid starts, no position is held. Based on the current price, long orders are opened when the price falls, and long orders are closed to take profit when the price rises.

If the price exceeds the opening price, all long orders are closed to take profit.

When the price continues to rise, short orders are opened, and one short order is opened for every 1 grid increase in price. When the price falls, short orders are closed to take profit.

And so on, arbitrage is circulated.

What are the advantages of futures grid?

1. Futures grids support the selection of direction (long or short), while spot grids can only go long.

2. Futures grids can be leveraged to obtain higher yields.

3. Compared with spot, the transaction fee rate of contracts is lower.

What Futures does the Futures grid bot support?

Currently supported Futures include USDT-based: BTCUSDT, ETHUSDT, SOLUSDT, ORDIUSDT, EOSUSDT, and more futuress will be added in the future.

Is there a limit on the number of futures grids?

Currently supported grid numbers range from 2 to 200.

How many futures grids can be run at the same time?

Yes, the limit of grid strategies running at the same time is 10.

Why is the total return negative, but the grid profit is positive?

Grid profit is the sum of arbitrage profits generated by each completed opening and corresponding closing order. The total return includes realized profit and loss and unrealized profit and loss. If there is a position in the strategy, the unrealized profit and loss of the position will also be included in the total return, and when the realized grid profit is not enough to offset it, a negative total profit and loss will be seen.

What functions are supported in the operation of the futures grid?

1. Manual stop strategy (cancellation/closing position)

2. Modify the highest and lowest termination prices

3. Adjust margin

4. Withdraw profits

5. Sharing strategy

What is the leverage ratio supported by the futures grid?

Support 1-20 times leverage.

What risks should be paid attention to when using the futures grid?

- Floating loss and forced liquidation risks that may be caused by the price exceeding the grid range: When the market price exceeds the highest or lowest price of the grid range, the futures grid will not continue to run. If the price has been unilateral and cannot return to the grid range, it may suffer floating losses and even have the risk of forced liquidation. It is recommended to set the stop loss price in advance and stop loss in time.

- Futures account risk: The funds invested after the futures grid is created will be transferred out of the futures account. Please pay attention to the position forced liquidation risk caused by the change of assets in the futures account.

Stay tuned to CoinCarp Social Media and Discuss with Us:

X (Twitter) | Telegram | Reddit

Download CoinCarp App Now: https://www.coincarp.com/app/

Up to $6,045 Bonuses

Sponsored

Join Bybit and receive up to $6,045 in Bonuses! Register Now!