Fiat currencies

Crypto Currencies

OKX will update margin calculation rules for the portfolio margin mode

To provide better trading services, OKX will update margin calculation rules for portfolio margin mode. This rule change will gradually affect users using portfolio margin mode starting from December 30, 2024, 08:00 (UTC). The new rules will be fully applied to all users by January 21, 2025, 08:00 (UTC).

To provide you with a preview and better understanding, these new product changes will be available in demo trading on December 17, 2024, 08:00 (UTC) .

Risk notice: These changes will result in your margin being adjusted. Please take precautionary measures against potential liquidation risk in your account.

Switching account modes while holding positions

Before updating the margin calculation rules for portfolio margin mode, we’ll first introduce a feature that allows you to switch account modes while holding positions. This means that you can switch to other account modes without needing to close your positions.

Risk unit merge

Risk unit merge: In the upgraded portfolio margin mode, risk units will be consolidated. Perpetual futures, expiry futures, and options with the same underlying asset will merge into a single risk unit, as shown in the table below.

Before

Mode | ETH-USDT risk unit | ETH-USDC risk unit | ETH-USD risk unit |

|---|---|---|---|

Derivatives only | ETHUSDT perpetual and expiry futures orders | ETHUSDC perpetual and expiry futures orders | ETHUSD perpetual futures, expiry futures, and options orders |

Spot-derivatives risk offset (USDT) | ETHUSDT perpetual and expiry futures, ETH spot, ETH/USDT and ETH/USDC spot orders | ETHUSDC perpetual and expiry futures orders | ETHUSD perpetual futures, expiry futures, and options orders |

Spot-derivatives risk offset (USDC) | ETHUSDT perpetual and expiry futures orders | ETHUSDC perpetual and expiry futures, ETH spot, ETH/USDT and ETH/USDC spot orders | ETHUSD perpetual and expiry futures orders |

Spot-derivatives risk offset (crypto) | ETHUSDT perpetual and expiry futures orders | ETHUSDC perpetual and expiry futures orders | ETHUSD perpetual futures, expiry futures, and options, ETH spot, ETH/USDT and ETH/USDC spot orders |

After

Mode | ETH risk unit |

|---|---|

Derivatives | ETHUSDT perpetual and expiry futures ordersETHUSDC perpetual and expiry futures orders ETHUSD perpetual and expiry futures orders ETHUSD options orders ETH spot orders ETH/USDT spot orders ETH/USDC spot orders |

Automatic inclusion of spot assets: In the upgraded portfolio margin mode, spot assets are automatically included in your selected risk unit for margin calculation. If spot assets and derivatives within the selected risk unit are in a hedged position, the required margin will be reduced accordingly.

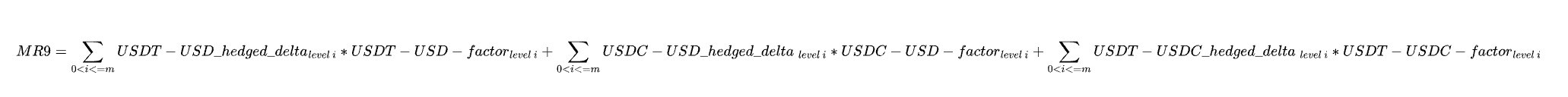

MR9: stablecoin depegging risk

In the upgraded portfolio margin mode, the risk units of different underlying assets will be merged. For example, BTC-USDT, BTC-USDC, and BTC-USD derivatives will merge into a single risk unit. This will allow cross-margining between derivatives and spot positions across different underlying assets. However, when a stablecoin depegs, this cross-margining could expose you to risk, which MR9 measures.

MR9 calculation logic:

Step 1: Calculate cash delta by underlying assets (USDT, USDC, USD), displayed in USD unit.

USDT-based perpetual and expiry futures: Cash delta = Contract size × Multiplier × Mark price × USDT to USD price × Position size

USDC-based perpetual and expiry futures: Cash delta = Contract size × Multiplier × Mark price × USDC to USD price × Position size

Other crypto-based perpetual and expiry futures: Cash delta = [1 / (Mark price × (1 0.01%))] × Contract size × Multiplier × The crypto’s USD-equivalent price

Options: Cash delta = Cash delta contract × Contract size × Multiplier × Mark price

Spot: Cash delta = Spot hedging amount × Crypto to USD price Spot order quantity × The crypto’s USD-equivalent price

Step 2: Calculate the total cross-currency hedging volume by group.

Using a fixed order, calculate hedging volumes as follows: USDT-USD, USDT-USDC, then USDC-USD. For example, to determine the USDT-USD hedging volume:

If USDT cash delta and USD cash delta are both positive or negative (or at least one equals to zero), then the USDT-USD hedging volume = 0.

Otherwise, USDT-USD hedging volume = Min {Abs(USDT cash delta), abs(USD cash delta)}.

Step 3: Calculate MR9 based on tiers.

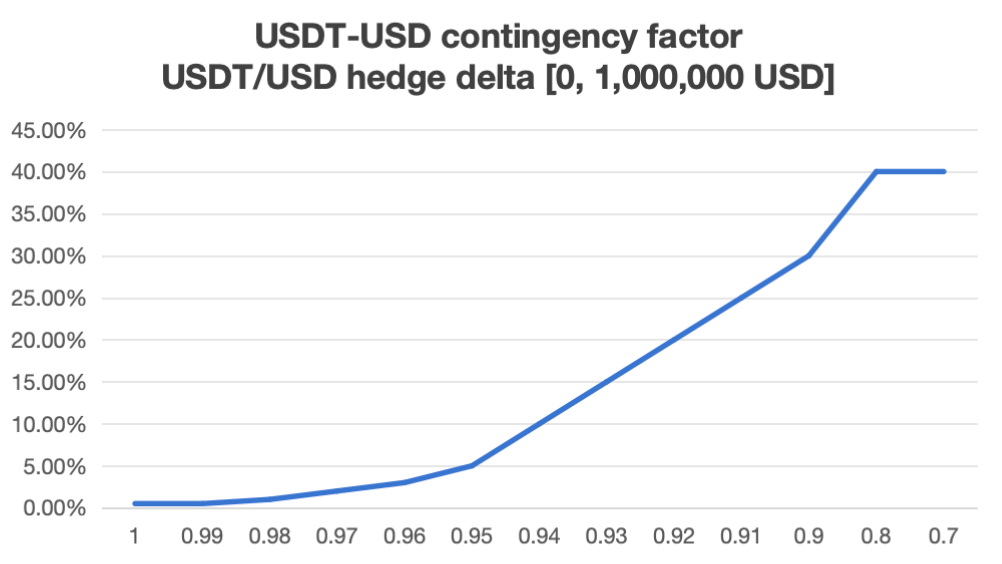

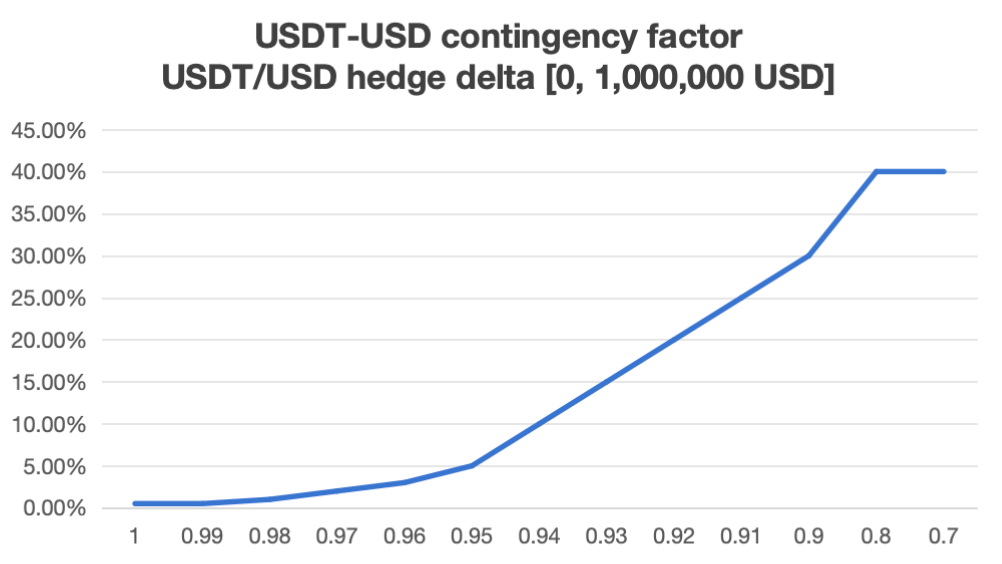

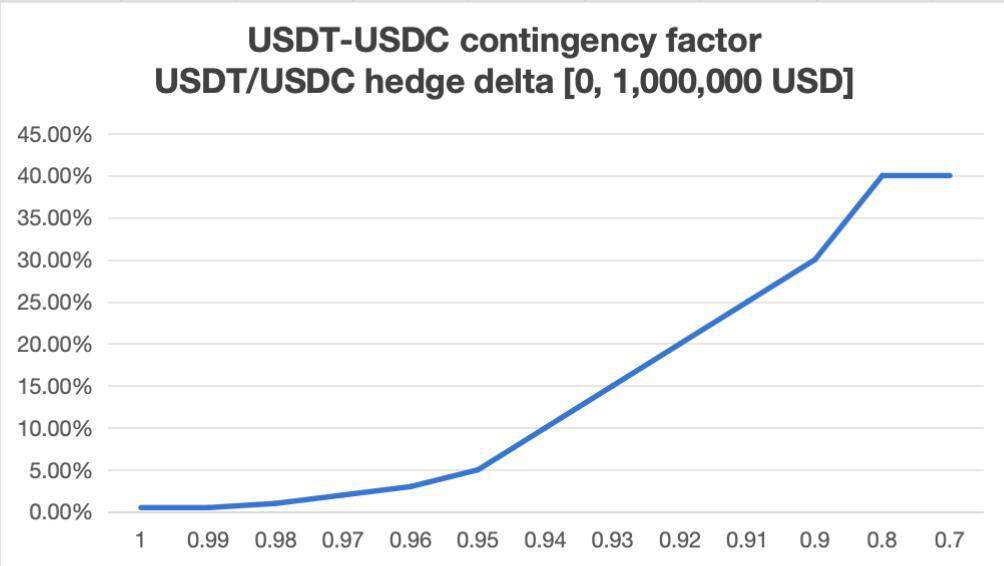

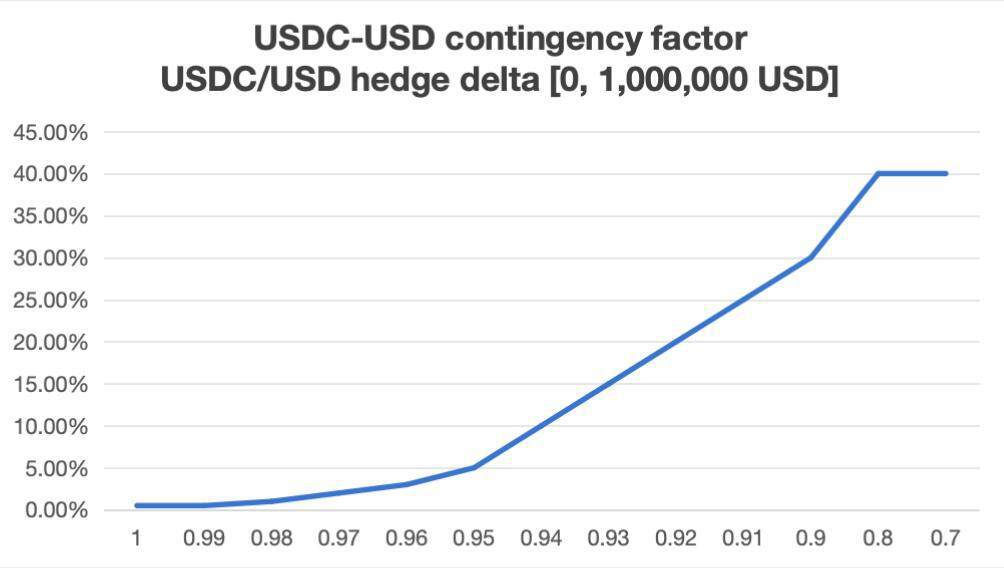

Calculate using the 3 cross-currency hedging volumes calculated in step 2: [USDT-USD hedging volume], [USDT-USDC hedging volume], [USDC-USD hedging volume], and index prices for [USDT/USD], [USDC/USD], and [USDT/USDC]. Then, refer to the different tiers in the tables below to determine the MR9 factor.

The factor value will be linearly interpolated if the current price is in between columns of the different hedge delta.

Example: If the USDT-USD hedging volume is 10,000,000 USD, and USDT/USD = 0.985 (falling under tier 3), then MR9 is calculated as follows:

Tier 1 factor value:

0.5% (0.99 – 0.985) / 1% × (1% – 0.5%) = 0.75%

Tier 2 factor value:

1.5% (0.99 – 0.985)/ 1% × (2% – 1.5%) = 1.75%

Tier 3 factor value:

2% (0.99 – 0.985) / 1% × (3% – 2%) = 2.5%

MR9 = 1,000,000 (max amount considered in tier 1) × 0.75% 4,000,000 (max amount considered in tier 2) × 1.75% 5,000,000 × 2.5% = 202,500 USD

Note: For each USDT-USD index price value, there’s a corresponding value associated with it (as shown in the example tier 1 graph above). A fixed factor won’t be applied.

For any value above 0.99, only the min factor of all values will be considered. For example, for tier 1, the min charge won’t be less than 0.5%, tier 2 won’t be less than 1%, and so on and so forth.

USDT-USD tiers

USDT-USD index = USDT dollar price Cross-currency hedging delta volume | Above 0.995 | 0.99 | 0.98 | 0.97 | 0.96 | 0.95 | 0.94 | 0.93 | 0.92 | 0.91 | 0.9 | Below 0.8 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Tier 1: 0 - 1,000,000 USD | 0.5% | 0.5% | 1% | 2% | 3% | 5% | 10% | 15% | 20% | 25% | 30% | 40% |

Tier 2: 1,000,000 - 5,000,000 USD | 1% | 1.5% | 2% | 3% | 4% | 6% | 12% | 18% | 21% | 27% | 30% | 40% |

Tier 3: 5,000,000 - 10,000,000 USD | 1.5% | 2% | 3% | 4% | 5% | 10% | 15% | 21% | 24% | 30% | 30% | 40% |

Tier 4: 10,000,000 - 20,000,000 USD | 2% | 3% | 4% | 5% | 6% | 12% | 18% | 24% | 30% | 30% | 30% | 40% |

Tier 5: 20,000,000 - 30,000,000 USD | 3% | 4% | 5% | 6% | 7% | 15% | 21% | 27% | 30% | 30% | 30% | 40% |

Tier 6: 30,000,000 - 40,000,000 USD | 4% | 5% | 6% | 7% | 8% | 17% | 27% | 30% | 30% | 30% | 30% | 40% |

Tier 7: 40,000,000 - 50,000,000 USD | 5% | 6% | 7% | 8% | 12% | 20% | 30% | 30% | 30% | 30% | 30% | 40% |

Tier 8: 50,000,000 USD | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 40% |

USDT-USDC tiers

USDT-USDC index = USDT dollar price/USDC dollar price Cross-currency hedging delta volume | Above 0.995 | 0.99 | 0.98 | 0.97 | 0.96 | 0.95 | 0.94 | 0.93 | 0.92 | 0.91 | 0.9 | Below 0.8 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Tier 1: 0 - 1,000,000 USD | 0.5% | 0.5% | 1% | 2% | 3% | 5% | 10% | 15% | 20% | 25% | 30% | 40% |

Tier 2: 1,000,000 - 5,000,000 USD | 1% | 1.5% | 2% | 3% | 4% | 6% | 12% | 18% | 21% | 27% | 30% | 40% |

Tier 3: 5,000,000 - 10,000,000 USD | 1.5% | 2% | 3% | 4% | 5% | 10% | 15% | 21% | 24% | 30% | 30% | 40% |

Tier 4: 10,000,000 - 20,000,000 USD | 2% | 3% | 4% | 5% | 6% | 12% | 18% | 24% | 30% | 30% | 30% | 40% |

Tier 5: 20,000,000 - 30,000,000 USD | 3% | 4% | 5% | 6% | 7% | 15% | 21% | 27% | 30% | 30% | 30% | 40% |

Tier 6: 30,000,000 - 40,000,000 USD | 4% | 5% | 6% | 7% | 8% | 17% | 27% | 30% | 30% | 30% | 30% | 40% |

Tier 7: 40,000,000 - 50,000,000 USD | 5% | 6% | 7% | 8% | 12% | 20% | 30% | 30% | 30% | 30% | 30% | 40% |

Tier 8: 50,000,000 USD | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 40% |

USDC-USD tiers

USDC-USD index = USDC dollar price Cross-currency hedging delta volume | Above 0.995 | 0.99 | 0.98 | 0.97 | 0.96 | 0.95 | 0.94 | 0.93 | 0.92 | 0.91 | 0.9 | Below 0.8 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Tier 1: 0 - 1,000,000 USD | 0.5% | 0.5% | 1% | 2% | 3% | 5% | 10% | 15% | 20% | 25% | 30% | 40% |

Tier 2: 1,000,000 - 5,000,000 USD | 1% | 1.5% | 2% | 3% | 4% | 6% | 12% | 18% | 21% | 27% | 30% | 40% |

Tier 3: 5,000,000 - 10,000,000 USD | 1.5% | 2% | 3% | 4% | 5% | 10% | 15% | 21% | 24% | 30% | 30% | 40% |

Tier 4: 10,000,000 - 20,000,000 USD | 2% | 3% | 4% | 5% | 6% | 12% | 18% | 24% | 30% | 30% | 30% | 40% |

Tier 5: 20,000,000 - 30,000,000 USD | 3% | 4% | 5% | 6% | 7% | 15% | 21% | 27% | 30% | 30% | 30% | 40% |

Tier 6: 30,000,000 - 40,000,000 USD | 4% | 5% | 6% | 7% | 8% | 17% | 27% | 30% | 30% | 30% | 30% | 40% |

Tier 7: 40,000,000 - 50,000,000 USD | 5% | 6% | 7% | 8% | 12% | 20% | 30% | 30% | 30% | 30% | 30% | 40% |

Tier 8: 50,000,000 USD | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 30% | 40% |

MR4: basis risk formula adjustment

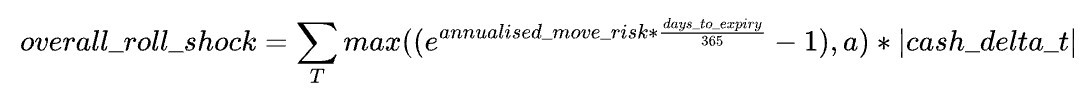

MR4 considers not only the basis risk but also time to more accurately reflect changes in risk across different time horizons.

Basis risk: This refers to the risk when the spot price of an asset and its perpetual or expiry futures price don’t move in sync. This divergence can lead to ineffective hedging. For example, if you hold BTC and sell BTC futures to hedge against a price drop, the difference between the spot and perpetual or expiry prices (the basis) may widen or narrow, resulting in unexpected gains or losses.

Basis = Futures price – Spot price = 51,000 – 50,000 = 1,000

Time as a factor in basis risk: Time to expiry is a key factor in basis risk. As a futures contract approaches its expiration, the futures price typically converges with the spot price, reducing the basis. However, before expiry, factors like market sentiment, interest rates, or liquidity can cause basis fluctuations and increase risk. The further away from expiry, the greater the basis volatility, which can destabilize the effectiveness of hedging.

The formula is as follows for each crypto:

Parameters explained

a(underlying minimum basis charge)

Fallback logic: This is a safeguard mechanism to protect the exchange, where we account for an extreme minimum fluctuation value.

Different values for each crypto: The value of a varies for each crypto, as shown in the table below:

Underlying asset | a |

|---|---|

BTC, ETH | 0.20% |

SOL, DOGE, PEPE, XRP, BNB, SHIB, LTC, ORDI, WLD, BCH, ADA | 0.80% |

Others | 2% |

Note: We have changed the assets in tier 2. Note that assets in tier 2 used to be LTC, BCH, EOS, DOT, BSV, LINK, FI, ADA, TRX, UNI, and XRP.

Annualized move risk

This represents the estimated annualized volatility or movement of a derivative. It quantifies the potential change in value that the derivative might experience over a 1-year period as a percentage.

This metric is commonly used to project the risk or fluctuation in value of assets when calculating margin requirements or risk exposure, particularly over different time horizons.

Underlying asset | Annualized move risk |

|---|---|

BTC, ETH | 7.50% |

SOL, DOGE, PEPE, XRP, BNB, SHIB, LTC, ORDI, WLD, BCH, ADA | 22.50% |

Others | 45.00% |

Note: We have changed the assets in tier 2. Note that assets in tier 2 used to be LTC, BCH, EOS, DOT, BSV, LINK, FI, ADA, TRX, UNI, XRP.

Days to expiry

Instrument | Days to expiry |

|---|---|

Spot | 0 |

Perpetual futures | 0.33 |

Expiry futures and options | Time to expiry – Today’s date (expressed as a decimal) |

Cash delta t

This groups the cash delta that has the same expiry date, resulting in cash delta t. If the underlying asset has 4 different days to expiry, the overall roll shock percentage charge will be summed up and multiplied by the cash delta t.Each instrument’s cash delta calculations

USDT-based perpetual and expiry futures: Cash delta = Contract size × Multiplier × Mark price × USDT to USD price × Position size

USDC-based perpetual and expiry futures: Cash delta = Contract size × Multiplier × Mark price × USDC to USD price × Position size

Other crypto-based perpetual and expiry futures: Cash delta = [1 / (Mark price × (1 0.01%))] × Contract size × Multiplier × The crypto’s USD-equivalent price

Options: Cash delta = Cash delta contract × Contract size × Multiplier × Mark price

Spot: Cash delta = Spot hedging quantity × The crypto’s USD-equivalent price Spot order quantity × The crypto’s USD-equivalent price

For example, if you hold spot, perpetual futures, expiry futures and options with 1 day to expiry, and expiry futures and options with 7 days to expiry, then:

Cash delta t (spot) = 5000

Cash delta t (perpetual futures) = -2000

Cash delta t (expiry futures or options with 1 day to expiry) = 3000

Cash delta t (expiry futures or options with 7 days to expiry) = 2000

MR1, MR6: parameter adjustments

We are adjusting tier 2 assets for MR1 and MR6. Note that these adjustments may affect the margin of some of your holdings.

Before | After |

|---|---|

LTC, BCH, EOS, OKB, DOT, BSV, LINK, FI, ADA, TRX, UNI, XRP | SOL, DOGE, PEPE, XRP, BNB, SHIB, LTC, ORDI, WLD, BCH, ADA |

Impact on MR1

Before

Underlying asset | Maximum price move |

|---|---|

BTC, ETH | /– 0%, 5%, 10%, 15% |

LTC, BCH, EOS, OKB, DOT, BSV, LINK, FIL, ADA, TRX, UNI, XRP | /– 0%, 7%, 14%, 20% |

Others | /– 0, 8%, 16%, 25% |

After

Underlying asset | Maximum price move |

|---|---|

BTC, ETH | /– 0%, 5%, 10%, 15% |

SOL, DOGE, PEPE, XRP, BNB, SHIB, LTC, ORDI, WLD, BCH, ADA | /– 0%, 7%, 14%, 20% |

Others | /– 0, 8%, 16%, 25% |

Impact on MR6

Before

Underlying asset | Maximum price move |

|---|---|

BTC, ETH | /– 30% |

LTC, BCH, EOS, OKB, DOT, BSV, LINK, FIL, ADA, TRX, UNI, XRP | /– 40% |

Others | /– 50% |

After

Underlying asset | Maximum price move |

|---|---|

BTC, ETH | /– 30% |

SOL, DOGE, PEPE, XRP, BNB, SHIB, LTC, ORDI, WLD, BCH, ADA | /– 40% |

Others | /– 50% |

OKX team

November 25, 2024

Stay tuned to CoinCarp Social Media and Discuss with Us:

X (Twitter) | Telegram | Reddit

Download CoinCarp App Now: https://www.coincarp.com/app/