Devise fiat

Crypto-monnaies

What Is Puffer Finance? How to Join PUFFER Airdrop?

Puffer Finance is making waves in the cryptocurrency and DeFi (Decentralized Finance) world. Known for its innovative approach to staking, Puffer Finance combines Ethereum's Proof-of-Stake (PoS) with native restaking capabilities on the EigenLayer foundation. With the backing of strategic investments and advanced technological mechanisms, Puffer Finance aims to provide users with enhanced security, lower barriers to entry, and maximized returns. This article explores what Puffer Finance is, how it works, and what makes it unique.

What Is Puffer Finance?

Puffer Finance operates as a native liquid restaking protocol built on the EigenLayer foundation. Its primary objective is to enable users to stake their Ethereum (ETH) and earn rewards through both Ethereum's PoS and restaking mechanisms. Unlike traditional staking methods, Puffer Finance offers a more accessible and secure way to become a validator, with as little as 1 ETH required to participate.

The Genesis of Puffer Finance

Puffer Finance was developed to address some of the critical challenges in the Ethereum staking ecosystem, such as high entry barriers, security concerns, and inefficiencies in reward mechanisms. By leveraging the EigenLayer foundation, Puffer Finance brings together advanced slashing mechanisms, capital-efficient strategies, and a focus on decentralization to create a more robust staking solution.

In May 2023, Puffer Finance received a grant from the Ethereum Foundation to support its open source remote signature tool Secure-Signer; in August of the same year, it announced the completion of a $5.5 million seed round of financing. This year, Puffer Finance received a strategic investment from Binance Labs and announced in April that it had completed a $18 million Series A financing.

What Are the Key Features of Puffer Finance?

- Native Liquid Restaking Protocol. By combining Ethereum's liquid staking with native restaking capabilities, Puffer Finance allows users to earn rewards through both mechanisms simultaneously. This dual approach enhances the overall return on staked assets.

- Accessibility. Validators can participate in the network with as little as 1 ETH. This lower barrier to entry encourages more individuals to become validators, contributing to the network's decentralization.

- Slash Protection. Puffer Finance employs advanced slashing mechanisms to protect staked assets. This added layer of security ensures that users' funds are safeguarded against potential slashing events.

- Capital-Efficient Strategies. The protocol uses capital-efficient strategies to optimize the restaking process, resulting in higher rewards compared to traditional staking methods.

- Decentralization. By making it easier for individuals to become validators, Puffer Finance promotes greater decentralization within the Ethereum ecosystem. A decentralized network is more robust and resilient against attacks.

- Strategic Investment. Puffer Finance has secured strategic investment from Binance Labs, the incubation and venture capital arm of Binance. This backing highlights the innovation and potential behind Puffer Finance.

How Does Puffer Finance Work?

Puffer Finance operates through a series of steps and mechanisms designed to maximize the security and efficiency of the staking process.

- Staking ETH. Users start by staking their ETH on the Puffer Finance platform. The minimum requirement is 1 ETH, making it accessible to a broader range of participants. Once staked, the ETH is used to support the Ethereum network's PoS mechanism.

- Native Restaking. In addition to staking ETH, Puffer Finance allows users to participate in native restaking. This involves reusing staked assets to earn additional rewards. The restaking process is optimized to ensure capital efficiency and maximize returns.

- Slash Protection. Puffer Finance implements advanced slashing mechanisms to protect users' staked assets. Slashing is a penalty imposed on validators who act maliciously or fail to perform their duties correctly. Puffer Finance's slash protection ensures that users' funds are safeguarded against such penalties, adding an extra layer of security.

- Reward Distribution. Rewards earned through both staking and restaking are distributed to users. The protocol uses capital-efficient strategies to ensure that users receive higher returns compared to traditional staking methods. The rewards are distributed periodically and can be claimed by users through the Puffer Finance platform.

- Decentralization and Security. By lowering the entry barriers for validators, Puffer Finance promotes greater decentralization within the Ethereum network. A decentralized network is more secure and resilient against attacks. Additionally, the use of advanced slashing mechanisms and capital-efficient strategies enhances the overall security and efficiency of the platform.

What Are the Benefits of Using Puffer Finance?

- Higher Returns. By combining staking and restaking mechanisms, Puffer Finance provides users with higher returns compared to traditional staking methods. The capital-efficient strategies used by the protocol optimize the reward distribution process, ensuring maximum returns for users.

- Enhanced Security. Puffer Finance's advanced slashing mechanisms protect users' staked assets against potential penalties. This added layer of security ensures that users' funds are safeguarded, providing peace of mind to participants.

- Lower Barriers to Entry. With a minimum requirement of 1 ETH to become a validator, Puffer Finance makes it easier for individuals to participate in the staking process. This lower barrier to entry encourages greater participation and contributes to the network's decentralization.

- Increased Decentralization. By promoting greater participation from individual validators, Puffer Finance enhances the decentralization of the Ethereum network. A decentralized network is more robust and resilient against attacks, ensuring the long-term stability and security of the platform.

Puffer Finance - PUFFER Token Airdrop

Puffer Finance has announced an airdrop for its governance token, PUFFER. Here are some key details about the PUFFER token airdrop:

- Airdrop Allocation: The airdrop campaign allocates 13% of the total token supply to the community. This means early adopters and eligible participants within the DeFi space will receive a portion of the tokens. Airdrop Season 1 (7.5%). 7.5% is allocated to the Crunchy Carrot Quest Season One airdrop, available immediately to reward early Puffer supporters from the Crunchy Carrot Campaign. 65% is available on day 1 and for larger depositors, the rest is vested over 6 months for equal opportunity for all of our community. Airdrop Season 2 (5.5%). 5.5% is allocated to our Crunchy Carrot Quest Season Two participants. Season 2 has already started after our snapshot of Season 1 on Oct 5th.

- Total Supply: The total token supply is capped at 1 billion PUFFER tokens, with an initial circulation of 102.3 million tokens.

- Distribution: The distribution includes 40% for ecosystem and community initiatives, 13% for airdrops, 1% for Ethereum core development, 20% for early contributors and advisors, and 26% for investors.

- Claim Period: The airdrop claim process will run from October 14, 2024, to January 14, 2025.

How to Participate in PUFFER Season 2 Airdrop?

At the end of the first season of Crunchy Carrot Quest, the season 2 has started. For users who missed the season 1 airdrop and have ETH in wallets, don’t miss the season 2 airdrop. The tutorial is as follows.

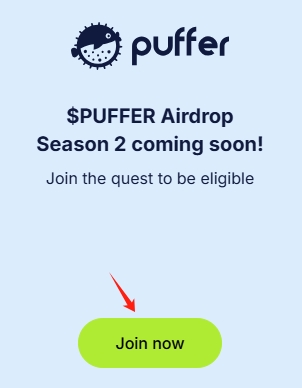

- STEP 1. Go to https://claims.puffer.fi/ and click "Join now" under Airdrop Season 2.

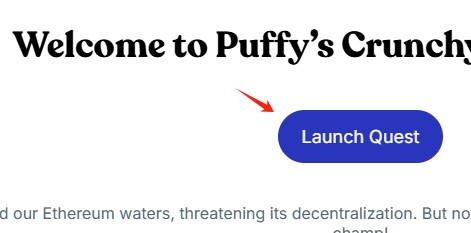

- STEP 2. Click "Launch Quest" and connect your wallet in Chapter 4.

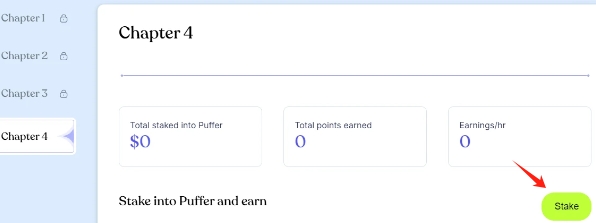

- STEP 3. Click "Stake" to stake. You can stake ETH, stETH (stETH can be obtained by staking ETH from Lido), and wstETH.

Conclusion

Puffer Finance represents a significant innovation in the world of Ethereum staking and DeFi. By combining native liquid restaking with advanced security mechanisms and capital-efficient strategies, Puffer Finance offers users a more accessible, secure, and rewarding staking experience. The platform's focus on decentralization and strategic investment from Binance Labs further enhances its credibility and potential for growth.

As the DeFi landscape continues to evolve, Puffer Finance is well-positioned to play a crucial role in shaping the future of Ethereum staking. Whether you're an individual looking to become a validator or an investor seeking higher returns, Puffer Finance offers a compelling solution worth exploring.

Retrouvez-nous sur:

X (Twitter) | Telegram | Reddit

Télécharger l'application CoinCarp maintenant: https://www.coincarp.com/app/

- Ethereum Outshines Bitcoin as Bybit Highlights Surge After Pectra Upgrade Débutant May 14, 2025 2m

- Ownership, Identity, and Now Control Make the Case for Blockchain in Gaming Débutant May 07, 2025 3m

- 9 Costly Mistakes Crypto Holders Make (And How to Avoid Them) Débutant Apr 29, 2025 3m

- Axiym Reaches $132 Million in Volume, Streamlining Global Payments via Avalanche Débutant Apr 24, 2025 2m