Devise fiat

Crypto-monnaies

What Is Yield Farming?

In the middle of 2020, thanks to Yield Farming, decentralized financial(DeFi) have achieved great development, shortly after one month, the total market value has increased from $2 billion to $8 billion. The locked tokens of DeFi have a breakthrough from $10 billion to $25billion. In order to get token rewards, investors rush to provide liquidity for DEXs, that is one of the reasons making yield farming and DeFi a great success.

What Is Yield Farming?

Yield farming is a process that allows cryptocurrency holders to generate high returns on their holdings or rewards in the form of additional cryptocurrency. With yield farming, users deposit cryptocurrencies into a lending protocol to earn interest from trading fees or get governance token rewards. The participants are called "yield farmers", the process is "yield farming".Yield farming works in a similar way to bank deposits. Yield farming protocols encourage users to stake or lock up their crypto assets in a smart contract-based liquidity pool, in return for transaction fees, interest from lenders, or a governance token. These returns are expressed as an annual percentage yield (APY). As more and more investors add funds to the related liquidity pool, the value of the issued returns will rise in value.

How Does Yield Farming Work?

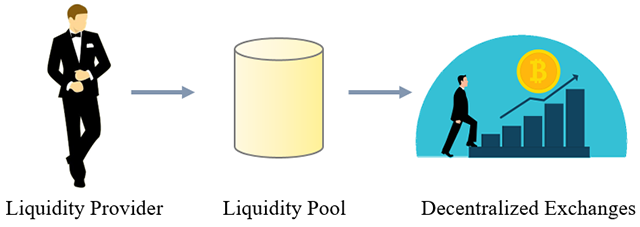

- Decentralized exchanges (DEX) use automated market makers (AMMs) to determine asset pricing and liquidity pool to make a trade without a counterparty. In this case, liquidity became so important because it determines the trading volume. To enlarge liquidity pools, DEXs encourage users to invest cryptocurrency in the liquidity pool to earn interest or token rewards. This is the basic purpose of yield farming.

- Liquidity providers add funds to a liquidity pool, which are essentially smart contracts that contain funds. The funds are the sources for exchange, borrow, or lend.

- After adding funds to a pool, providers will be rewarded with fees generated from the underlying DeFi platform. Reward tokens themselves can also be deposited in liquidity pools, and it's common practice for people to shift their funds between different protocols to chase higher yields. Those providing liquidity are also rewarded based on the amount of liquidity provided.

Why Yield Farming Became So Popular?

There are mainly two reasons which making yield farming became popular:

- High investment income: The annualized deposit interest rate of sUSD's in Aave is 11.5%, and the annualized deposit interest rate of USDC's in Nuo has reached 13.03%.

- Liquidity Mining system, through participating in the transaction of DeFi protocol fund pool, users can obtain relevant token rewards.

What Are the Most Popular Yield Farming Protocols?

The following platforms offer variations of incentivized lending and borrowing from liquidity pools:

- Uniswap: It is a hugely popular decentralized exchange (DEX) and automated market maker (AMM) that enables users to swap almost any ERC20 token pair without intermediaries. Liquidity providers deposit an equivalent value of two tokens to create a market. Traders can trade against that liquidity pool. In return for supplying liquidity, liquidity providers earn fees and UNI governance tokens from trades that happen in their pool.

- MakerDAO: Anyone can open a Maker Vault where they lock collateral assets, such as ETH, BAT, USDC, or WBTC, and earn interest in form of stability fees.

- Compound: Compound is a money market like a bank where users can lend and borrow assets. Anyone with an Ethereum wallet can supply assets to Compound's liquidity pool and earn rewards that immediately begin compounding. The rates are adjusted algorithmically based on supply and demand. The compound also provides governance token COMP as a reward to its lenders.

- Aave: Aave is a decentralized lending and borrowing platform to creates money markets, where users can borrow assets and earn compound interest for lending in the form of the AAVE (previously LEND) token. Aave is also known for facilitating flash loans and credit delegation, where loans can be issued to borrowers without collateral.

- Balancer: Balancer is a liquidity protocol similar to Uniswap and Curve that distinguishes itself through flexible staking. It doesn't require lenders to add liquidity equally to both pools. This allows liquidity providers to create custom balancer pools instead of the 50/50 allocation required by Uniswap. Just like with Uniswap, LPs earn fees for the trades that happen in their liquidity pool.

What Are the Risks of Yield Farming?

- It is usually subject to high Ethereum gas fees, which means only worthwhile if thousands of dollars are invested.

- Impermanent loss and price slippage when markets are volatile.

- Yield farming is susceptible to hacks and fraud due to possible vulnerabilities in the protocols' smart contracts.

- Many liquidity pools are convoluted scams that the developers withdraw all liquidity from the pool and abscond with funds.

Retrouvez-nous sur:

X (Twitter) | Telegram | Reddit

Télécharger l'application CoinCarp maintenant: https://www.coincarp.com/app/

- Smoothing Out Volatile Times with Gas Token Flexibility Débutant Apr 16, 2025 4m

- Venga Introduces Euro IBAN Accounts to Streamline Fiat-to-Crypto Transfers in the EU Débutant Apr 15, 2025 2m

- 8 Best Crypto Sports Betting Sites in Canada [2025] Débutant Apr 14, 2025 9m

- 8 Best Crypto Sports Betting Sites in the UK [2025] Débutant Apr 14, 2025 8m