フィアット通貨

仮想通貨

"" の結果はありません

検索に一致するものが見つかりませんでした。別の用語でもう一度お試しください。

How to Use Curve Finance?

Curve Finance provides users with a range of opportunities, such as staking in DeFi liquidity pools, yield farming, and transferring stablecoins. This platform is relatively new to the crypto market, but it is already making waves with its comprehensive suite of benefits. This article will briefly introduce the features and usage of Curve Finance.

What Is Curve Finance?

Curve Finance is a decentralized exchange (DEX) on Ethereum that stands out from Uniswap due to its focus on liquidity pools made up of similar assets such as stablecoins, or wrapped versions of the same type of assets, like wBTC and tBTC. This allows Curve to employ more efficient algorithms and offer the lowest fees, slippage, and impermanent loss of any DEX on Ethereum.

Users of Curve Finance can also take advantage of yield-bearing tokens such as those from Yearn Finance, where users can join the yUSD pool comprised of yDAI, yUSDT, yUSDC and yTUSD. Not only do participants of the pool gain the swap/gas fees generated by Curve, but they also receive the yield from the associated yield-bearing tokens.

How Does Curve Finance Work?

The pricing for assets is calculated using a formula that is tailored to swaps within the same range. For example, 100 USDT should be equivalent to 100 USDC, which should be equal to 100 BUSD. If you swap 10 million dollars worth of USDT for USDC and then convert it to BUSD, you will experience slippage. Curve's formula is created to reduce this slippage, even when making large transactions.

For achieving this, Curve Finance created an AMM exchange with low fees for traders and efficient fiat savings account for liquidity providers. Its focus on stablecoins allows investors to avoid the volatility of other crypto assets while still earning high-interest rates from lending protocols. Curves's model is notably conservative in comparison to other AMM platforms, as it prioritizes stability over speculation and volatility.

Moreover, the AMM (Automatic Market Maker) is responsible for keeping the liquidity pools in balance. For example, if a pool contains USDC and TUSD, and a trader at Curve Finance sells USDC, it will cause the pool to become unbalanced, as there is now more USDC. To rebalance the pool, the price of USDC is dropped to incentivize traders to buy USDC with TUSD. This in turn attracts arbitrage traders who buy TUSD with USDC, allowing the pool to rebalance the ratio of USDC to TUSD. This price incentive is what keeps the liquidity pools balanced. Curve has implemented strategies to minimize impermanent loss for liquidity providers. This is when token values can decrease compared to their market values due to volatility in liquidity pools. To do this, Curve has limited the pools and the types of assets that can be included in each pool. Curve's DeFi composability also makes it an attractive choice for liquidity providers as it allows them to use their investments on the Curve platform to gain rewards on other DeFi platforms. Furthermore, Curve's pools contain tokenized versions of Bitcoin like wBTC and rBTC which can exist in the same pool, unlike other tokens such as wBTC and USDC.

Is Curve Swap Safe?

Similar to other DeFi protocols, Curve Finance is currently still in the experimental phase and is thus a work in progress. When depositing funds into such protocols, users must be aware that their funds are at risk of smart contract vulnerabilities, malicious developers, and hacks. This is a risk that comes with all cryptocurrencies, so it is essential to carefully evaluate the risks before entering into any new protocol or purchasing any cryptocurrency. It is wise to only invest what you are willing to lose.

While Curve Finance has gone through an audit, it is still not exempt from failure. Since it is mainly built on stablecoin pools, which are pegged to an underlying asset, if the peg fails and the prices drop, the liquidity providers in that pool will only be left with the unpegged stablecoins.

Additionally, Curve Finance supplies liquidity to partners such as yearn.finance, which is known as composability and helps to achieve higher returns for liquidity providers. However, this interaction also carries a risk of chain collapse in the event of any problems with a connected DeFi protocol or partner.

How to Swap on Curve Finance?

Step 1: Visit the official site of Curve Finance: https://curve.fi/

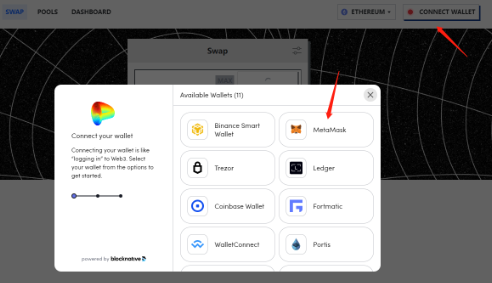

Step 2: Connect your wallet to Curve. It supports most of the Ethereum-based wallets. We're going to use Metamask wallet, for example.

Step 3: Get some tokens into your Metamask initially. You can buy tokens such as ETH or USDT from CEX.

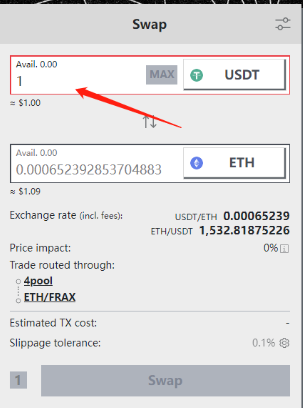

Step 4: Input the amount of tokens you want to swap.

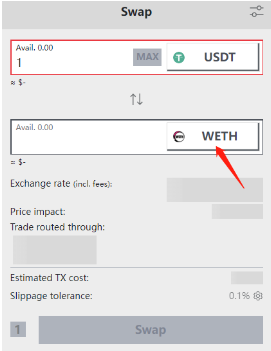

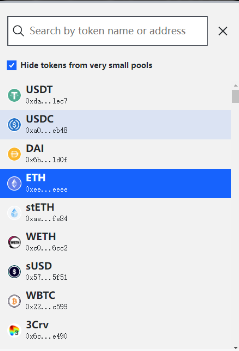

Step 5: Select the target token or coin that you want to swap:

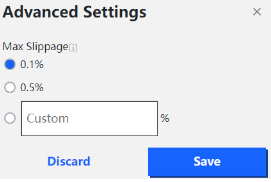

Step 6: Set up slippage tolerance, the default of 0.1% is low. However, during times of high traffic on the network or if you're trading a very large amount or through two assets that maybe require a larger amount of slippage, you can set Max Slippage up:

Step 7: Click "Swap", then confirm on Metamask.

Note: If you want cheaper fees, you can switch networks to one of the cheaper networks like Polygon or Optimism.

How to Provide Liquidity on Curve?

Similar to every other AMM or every other DEXs, where you can put a couple of different digital assets into a liquidity pool, and then you get some of the fees that people pay, so you can earn 3%-5% on stablecoins that go up during times of high network activity.

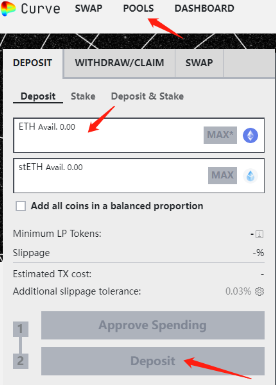

Step 1: Click on "POOLS" and switch to the pools tab.

Step 2: Choose one of the pools and enter. When you add liquidity to a liquidity pool, you have to add all of the tokens listed on the target pools.

Step 3: Deposit the assets you would like to provide liquidity and click "Deposit".

Curve Finance Fee

Fees on those pool range from 0.04% to 0.4%. The current fee varies based on how close the price is from the internal oracle. You can check a pool's current fee which changes every trade on the bottom of a pool page.

What Is CRV Token?

$CRV officially launched on the 13th of August 2020. The main purposes of the Curve DAO token are to incentivise liquidity providers on the Curve Finance platform as well as to get as many users involved as possible in the governance of the protocol. Currently, CRV has three main uses: voting, staking, and boosting. Those three things will require you to vote to lock your CRV and acquire veCRV.

You can acquire the CRV token in two ways: buying it or earning it with yield farming. Yield farming involves depositing assets into a liquidity pool and earning tokens as a reward. If you provide DAI to a Curve liquidity pool, you will receive the CRV token in addition to fees and interest. Yield farming CRV tokens not only provide a financial asset but also give a chance to own a portion of a successful DeFi protocol.

Closing Thought

Curve Finance has a prominent presence in the DeFi arena, though it has slight learning difficulties. While there are other options, the platform's dedication to various liquidity pools makes it one of the most popular platforms on DeFi.

Stay tuned to CoinCarp Social Media and Discuss with Us:

- Chainlink Poised for Breakout: Could LINK Break $46? 初級 2分

- Venga Takes Proactive Steps Toward EU Compliance with MiCA Pre-Application 初級 2分

- Singularity Finance Partners with Particle Network to Streamline Blockchain and AI Integration 初級 2分

- Why Are Telegram Mini-Games The Key To Web3 Gaming Adoption? 初級 5分