명목화폐

암호화폐

What Are the Top 10 Solana Projects?

Solana is an open-source blockchain project similar to Ethereum, developers can use it to build energetic projects and create decentralized ecosystems. With the features of high throughput and low costs, some people even call Solana "Ethereum-Killer". Till now, there are more than 500 projects built on Solana. These projects have attracted billions of crypto enthusiasts to join and invest. Among these projects, this article will try to find out the top 10 Solana Projects base on the market cap, volume, Twitter followers.

Top 10 Solana Projects Data

Name | Price | Market cap | Volume | Twitter Followers |

|---|---|---|---|---|

Raydium (RAY) | $11.91 | $900,347,435 | $95,143,159 | 223.2K |

Serum(SRM) | $7.48 | $373,925,000 | $208,497,211 | 163.8K |

Oxygen(OXY) | $2.28 | $570,900,000 | $1,091,575 | 27.4k |

Bonfida(FIDA) | $9.57 | $431,575,763 | $6,132,714 | 51.9k |

Mango Markets(MNGO) | $0.39 | $386,200,000 | $5,167,321 | 69.5K |

Kin(KIN) | $0.000101 | $167,134,202 | $5,323,999 | 45.5K |

Aurory(AURY) | $18.59 | $176,558,450 | $16,853,264 | 144.5K |

Tulip Protocol(TULIP) | $37.25 | $30,366,097 | $7,108,952 | 44.6K |

Saber(SBR) | $0.20 | $19,583,090 | $2,566,897 | 58.6K |

- All info in this article is purely educational and should only be used to inform your own research. We're not offering investment advice, endorsement of any project or approach, or promise of any outcome.

- Data: 10 Nov,2021

- Some projects such as ChainLink, Graph, etc. will not be listed in this article because they are not totally built on the Solana blockchain, though they are part of the Solana ecosystem.

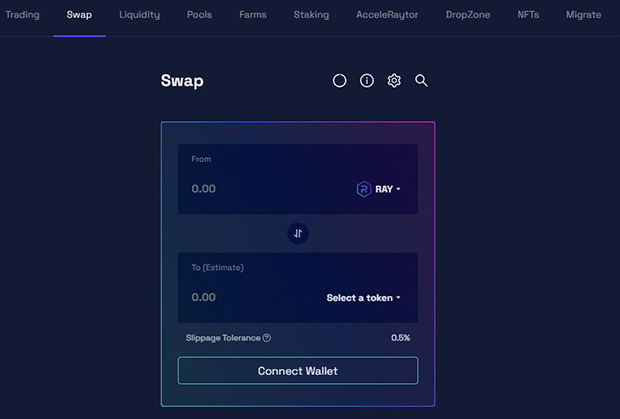

Raydium (RAY)—An Avenue for the Evolution of DeFi

Raydium is a liquidity provider and automated market maker (AMM) built on the Solana blockchain which leverages the central order book of the Serum decentralized exchange (DEX). Unlike other AMMs, Raydium uses the existing Serum order flow to provide liquidity in the pool and benefit the entire ecosystem.

Raydium's Best Price Swaps feature determines whether swapping within a liquidity pool or through the Serum order book will provide the best price for users.

Not only can you trade and swap on Raydium, but there are a number of ways you can earn additional rewards while farming liquidity pools and staking.

Serum(SRM)—Faster, Cheaper and more Powerful DeFi

The Serum is a decentralized derivatives exchange with trustless cross-chain trading and low transaction fees and high speed. It is built on Solana and is completely permissionless. The Solana-based Serum DEX will have the speed, cost, and UX that users expect from a centralized exchange–all while being trustless and noncustodial. And because of Serum's full cross-chain integration, users will be able to trade BTC, ETH, ERC20s, SPL tokens (the token standard on the Solana blockchain), and more on it. This will finally give DeFi users a fully decentralized exchange that has the experience they've come to expect from CeFi. They claim it can realize 65,000 TPS, 400ms block times, $0.00001 transaction cost.

Oxygen(OXY)—Pools-based Financial Infrastructure

Oxygen is a DeFi prime brokerage service built on Solana and powered by Serum's on-chain infrastructure. Built to support 100s of millions of users, it serves as a permissionless, cheap, and scalable protocol that democratizes borrowing, lending, and trading with leverage and allows you to make the most of your capital.

With Oxygen, you can earn yield, borrow from peers, trade directly out of your pools, and get trading leverage against a portfolio of assets.

Bonfida(FIDA)—Build on Top of the Serum and Solana Ecosystem

Bonfida is the full product suite that bridges the gap between Serum, Solana and the user. Bonfida claims they are the flagship Serum GUI and bring first of its kind Solana data analytics to the field and their API is used by some of the largest market makers in the space and has seen a growth of requests of 25% week over week.

The goal for Bonfida is to remain as the flagship Serum GUI. Bonfida is currently the best GUI because it provides the features Serum users ask for and has the best UX/UI. In order to grow its user base, Bonfida aims to achieve the following:

- Exclusive markets and listing

- On-chain Advanced order types

- Order Placement Through TradingView Charts

- Advanced UI and Basic UI

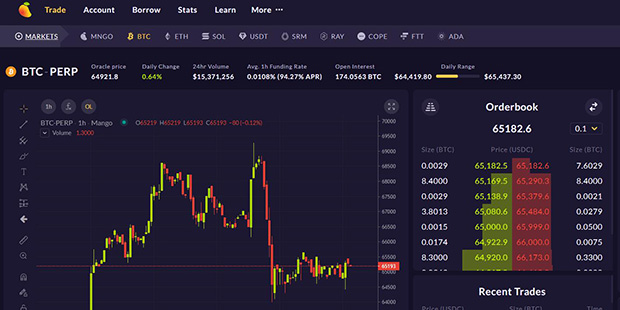

Mango Markets(MNGO)—Long & short Everything

Mango Markets is built on Solana, offers an approachable and powerful platform for trading, lending, and portfolio management. Mango not only offers spot margined and leveraged perpetual futures markets but also allows collateralized loans against existing assets all under one unified experience.

Trade spot margined markets with up to 5x leverage and perpetual futures markets with up to 10x leverage.

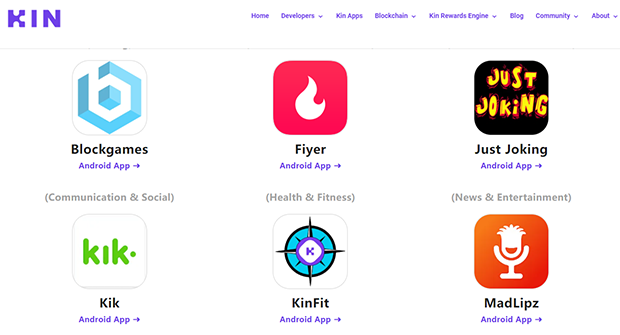

Kin(KIN)—Decentralized Ecosystem of Digital Services

NKN is the new kind of P2P network connectivity protocol & ecosystem powered by a novel public blockchain. NKN uses economic incentives to motivate Internet users to share network connections and utilize unused bandwidth to provide a decentralized data transmission network that can be used to build applications that require real-time data transmission, message delivery, content distribution, etc. NKN's open, efficient, and robust network infrastructure enables application developers to build the decentralized Internet so everyone can enjoy secure, low-cost, and universally accessible connectivity.

The main use cases for NKN are networking-focused applications. For example, nCDN (new kind of Content Delivery Network) for faster video streaming; PubSub for chat/IM, IoT data streaming and control, real-time price info.

Aurory(AURY)—Blockchain Play-to-Earn Game Platform

Aurory is a gaming platform based on the play-to-earn mechanism. Aurory uses play-to-earn mechanics, allowing players to earn tokens and NFTs while playing the game. Aury token is built on the Solana blockchain, offering scalability and low fees for an optimal user experience and a low barrier to entry. The Aurory Marketplace will be the central hub for players to buy, sell, and trade items, consumables, and cosmetics. The marketplace is powered by Serum, a decentralized exchange platform optimized for near-instant settlement.

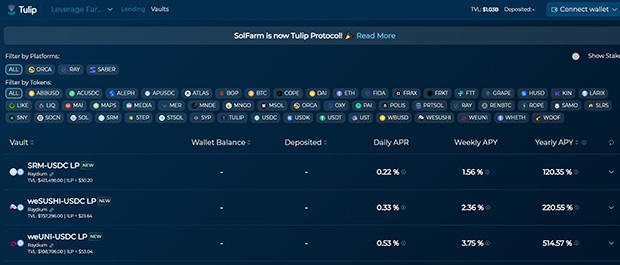

Tulip Protocol(TULIP)—Solana's Yield Aggregation Platform

Tulip Protocol(Former name: SolFarm) is the first yield aggregation platform built on Solana with auto-compounding vault strategies. The dApp (decentralized application) is designed to take advantage of Solana's low-cost, high-efficiency blockchain, allowing the vault strategies to compound frequently. This allows stakers to benefit from higher APYs without requiring active management.

Saber(SBR)—DeFi's Cross-chain Liquidity Network

Saber is the leading cross-chain stablecoin and wrapped assets exchange on Solana. Saber provides the liquidity foundation for stablecoins, which is a type of cryptocurrency whose value is pegged to another asset, like the US dollar or bitcoin. As Solana’s core cross-chain liquidity network, Saber helps facilitate the transfer of assets between Solana and other blockchains. Users deposit crypto into a Saber liquidity pool to earn passive yield from transaction fees, token-based incentives, and eventually automated DeFi strategies.

Conclusion

According to the official website, there are approximately 500 projects in the Solana ecosystem, cover from NFTs, De-Fi, Apps, Tools, and DEX. Thanks to the fast speed (400 millisecond block times) and low cost (less than $0.01 for both developers and users), in the top 10 Solana projects, most of them are De-Fi or De-Fi related. The market cap and volume will change every day, new Solana projects will be launched each day. If you want to invest in Solana projects, you can follow the Top Solana Ecosystem Tokens by 24h Price Change on Coincarp.com.

에서 찾아주세요:

X (Twitter) | Telegram | Reddit

지금 CoinCarp 앱을 다운로드하세요: https://www.coincarp.com/app/

- 9 Costly Mistakes Crypto Holders Make (And How to Avoid Them) 초급 Apr 29, 2025 3분

- Axiym Reaches $132 Million in Volume, Streamlining Global Payments via Avalanche 초급 Apr 24, 2025 2분

- NodeHaus Debuts as Real-Time RPC Monitoring Tool for Blockchain Foundations 초급 Apr 24, 2025 2분

- Hermetica Launches 2.0 Update, Boosting Bitcoin-Backed Stablecoin Transparency and Usability 초급 Apr 23, 2025 2분