명목화폐

암호화폐

"" 해당 결과 없음

검색에 일치하는 항목을 찾을 수 없습니다.다른 용어로 다시 시도하십시오.

What Cause Binance FUD?

The crypto industry is abuzz with fear, uncertainty, and doubt (FUD) as Binance, the world's largest cryptocurrency exchange, faces multiple controversies. Reports have surfaced of a potential investigation into money laundering and a dramatic increase in customer withdrawals since the weekend, stirring up rumors of financial instability. These events have sent shockwaves through the sector and sparked trepidation about the future of the exchange. Is there potential for a Binance-related crisis similar to FTX's, or is the speculation unwarranted? This article will review all the news happening these days that make FUD(fear, uncertainty, and doubt) increase to Binance.

Crypto Outflow from Binance on Dec 13

According to the report of Coindesk, Binance has seen a total net outflow of $902 million within the last 24 hours, making it the largest outflow amongst centralized exchanges. Compared to the second-largest outflow, this sum is almost nine times larger. Blockchain analysis reveals that two major crypto market makers, Jump Trading and Wintermute, were responsible for a large portion of the withdrawals. Nansen's data shows that Jump Trading was responsible for a net withdrawal of $146 million in digital assets over the last seven days, including $102 million of Binance's USD (BUSD), $14 million of Tether's USDT, and $10 million of Ether (ETH).

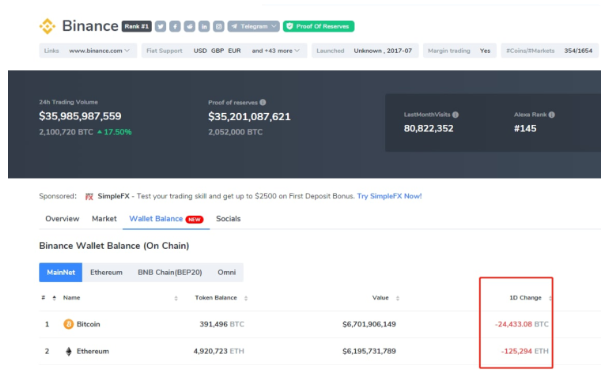

After the news was released, investors rushed to Binance and withdraw their assets, according to CoinCarp.com, about 24,433 BTC and 125,294 ETH were removed from the Binance on-chain wallet on Dec. 13th.

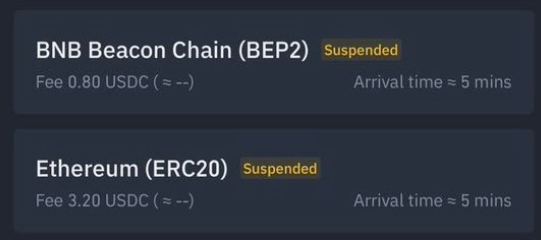

Binance Paused the USDC Withdrawals

On the same day(Dec. 13th), Binance paused all the USDC withdrawals on ETH and BNB chains.

In a tweet, Travis Kling, founder and chief investment officer of Ikigai Asset Management, called Binance's suspension of USDC withdrawals on ETH and BNB chains "super super shady." Binance CEO Changpeng Zhao responded quickly by linking to a Dec. 9 blog post announcing network upgrades and hard forks, (although it didn't imply why ERC-20 USDC withdrawals were frozen), asking, "Yo, what's with all the FUD?" He had also tweeted Tuesday morning that Binance was temporarily pausing USDC withdrawals for a token swap. Later that day, Binance tweeted that USDC withdrawals were back online.

What's Behind Binance FUD?

- Proof of Reserves Issue - Reserves are Dwindling

The Twitter user Karl has demonstrated via a graph that Binance's reserves have decreased by $3 billion, now sitting at $63.5 billion. There is an increasingly widespread rumor that the trust in a centralized exchange is diminishing, which is supposedly due to a decrease in its reserves as well as a potential bank run.

Last month, FTX filed for bankruptcy and its founder and former CEO, Sam Bankman-Fried, was arrested by Bahamian authorities on Monday. To ensure its users' assets are secure, Binance reportedly has equivalent funds to cover them one-to-one. Last week, they released a proof-of-reserves report led by the accounting and tax advisory firm Mazars. According to the report, Binance had 597,602 BTC in liabilities and 575,742 BTC in assets, creating a difference of 21,860 BTC. Binance stated on Twitter that the 3% "gap" is due to Bitcoin loaned to customers through their margin or loan programs, with collateral being tokens out of the report's scope.

(Binance Proof Of Reserves Tag on CoinCarp)

John Reed Stark, an ex-head of the SEC Office of Internet Enforcement and a vocal crypto opponent, aired his anxieties about Binance's attestation on Twitter. According to Stark, the report doesn't tackle the effectiveness of internal financial controls, doesn't give an opinion or assurance conclusion, and doesn't back the numbers. He added, "I worked at SEC Enforcement for 18-plus years. This is how I define red flag." The potential "worst case scenario" is in the event of a bank run on Binance, where "liquidity dries up" and users are unable to convert to dollars or withdraw their tokens to any chain. Soon afterward, the media was informed by Binance that they are getting ready to offer proof of reserves for additional tokens. A representative of the company expressed that they are dedicated to transparency and trustworthiness within the ecosystem. They said they will provide more updates on their other initiatives when they have more information.

- Criminal Investigation by U.S. Department of Justice

Reuters reported in an article entitled "Justice Dept is split over charging Binance as crypto world falters" that since its launch in 2018, Binance has been suspected of being a site for illicit activity.

In 2018, an investigation was launched to examine Binance's adherence to U.S. anti-money laundering laws and sanctions. According to two of the sources, some of the at least six federal prosecutors involved in the case consider the evidence collected to be sufficient for quickly prosecuting the exchange and charging Changpeng Zhao, the founder of Binance, with criminal offenses. However, other prosecutors have argued for taking more time to analyze the evidence, the sources added.

However, Binance clarified on Twitter, "Reuters has it wrong again. Now they're attacking our incredible law enforcement team. A team that we're incredibly proud of – they've made crypto more secure for all of us."

Closing Thought

The FTX-style crisis incident amplified the unrest and fear in the market, which can easily evoke FUD (fear, uncertainty, and doubt) in investors. In a bear market, any negative news is likely to trigger panic and increase the potential of a bank run. Though Binance has shot back against "FUD" , crypto markets still evoke public unease.

Stay tuned to CoinCarp Social Media and Discuss with Us:

Up to $6,045 Bonuses

Sponsored

Join Bybit and receive up to $6,045 in Bonuses! Register Now!