명목화폐

암호화폐

What Is the Fundamental Analysis (FA) for Cryptocurrencies?

When people dealing with securities or cryptocurrencies, we are all wishing to predict the trends of the market. Unfortunately, there are no certain accurate scientific methods to 100% predict such things. However, there are a vast array of tools and methodologies employed by traders and investors to analyze the market trade, they are fundamental analysis (FA) and technical analysis (TA). In this article, we will discuss the Fundamental Analysis (FA) for Cryptocurrencies.

What Is Fundamental Analysis(FA)?

Before talking about the fundamental analysis for cryptocurrencies, you may need to understand the concept of fundamental analysis. It is the method that through examining related economic and financial factors to measure assets (such as security) ' intrinsic value. Fundamental analysts study anything that can affect the assets' value, from external such as the state of the economy and industry conditions to internal factors like the effectiveness of the company's management. The goal is to figure the assets are overvalued or undervalued, which will help traders find out the proper strategy to gain better profit.

Take the stock market, for example, an investor can perform fundamental analysis on a security value by looking at economic factors such as the overall state of the economy and interest rates, then studying information about the related company, such as the company's earnings, balance sheets, financial statements, future growth, return on equity, cash flow, and other factors determine a company's underlying value and potential for future growth.

In the traditional stock or bond market, there are a handful of FA-specific indicators that are used. Such as

Earnings per share (EPS), Price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, Price/earnings-to-growth (PEG) ratio.

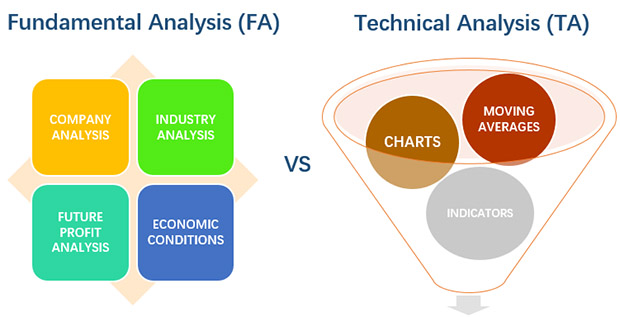

What's the Difference Between Fundamental Analysis (FA) and Technical Analysis (TA)?

Apart from fundamental analysis, we may confront another methodology, technical analysis (TA). It is the method by analyzing the past price action and volume data to predict the future price movement. Technical analysts don't concern themselves with studying external factors, preferring instead to focus on price charts, patterns, and trends in markets. They aim to identify ideal points for entering and exiting positions. Actually, these two strategies both can present valuable insights into different areas, many traders use a combination of both to make their decisions.

What Is the Fundamental Analysis (FA) for Cryptocurrencies?

As for cryptocurrencies, the indicators of fundamental analysis are different from the traditional stock or bond market. The following indicators are widely used by cryptocurrency traders to make decisions:

1.NVT Ratio

Network Value to Transaction (NVT) Ratio describes the relationship between market cap and transfer volumes. It is considered similar to the PE (price to earnings) Ratio used in stock markets. When NVT is high, this indicates that the network value is outpacing the value being transferred on the network. This could represent legitimate growth stages, or overvalued. Conversely, when NVT is low, this means that network value isn't keeping up with increased usage of the network, which can be considered undervalued.

NVT is calculated by dividing Market Cap by daily Transfer Volume.

NVT Ratio=Market Cap [USD] / Transaction Volume [USD]

2.Cost of Mining

For many cryptocurrency traders, a key fact to judge the price of a certain coin can be the cost of production during the mining process. As we all know, most of the coins are produced through "mining". If mining is at a loss, miners tend to leave the network unless the price increase. However, more miners are more likely to join to mine a coin which is profitable. Then the supply of coins will be affected, which can be related to the final price.

3.Active Addresses

The active addresses can indicate the activities of the market. In short, it can reveal information about network activity more or less.

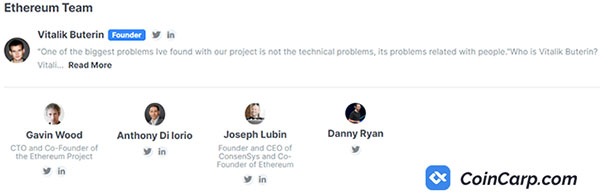

4.Background Information of the Coin

Research on the background is necessary, especially new listed coins or tokens. Traders could predict the potential of digital assets through reading the white paper, information of the team members, and roadmap.

These materials will show you the goal of the project and the team's ability which can help to complete the research on the project.

에서 찾아주세요:

X (Twitter) | Telegram | Reddit

지금 CoinCarp 앱을 다운로드하세요: https://www.coincarp.com/app/

- Transak Secures Austrac Registration, Expanding Crypto Access in Australia 초급 Mar 06, 2025 2분

- Earning Crypto the Smart Way with Sustainable Yields and No Speculation. Here’s How 초급 Mar 05, 2025 3분

- SupraSTM Introduces Conflict-Aware Parallel Execution for Blockchain Scalability 초급 Feb 27, 2025 2분

- Blockchair Introduces Stacks Explorer to Boost Bitcoin Layer 2 Transparency 초급 Feb 25, 2025 2분