Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

What Is a 51% Attack?

What Is the Definition of 51% Attack?

A "51% attack" refers to an attack on a blockchain by a single miner or a group of miners controlling more than 50% of the network's mining hash rate or computing power and double-spend some of its coins.

- The attackers would be able to prevent new transactions from gaining confirmations, allowing them to halt payments between some or all users. They would also be able to reverse and edit transactions that were completed while they were in control of the network, meaning they could double-spend coins.

- However, They would certainly not be able to create new coins or alter old blocks, modify other people's transaction records, nor can they prevent the sending of transactions. A 51% attack would probably not destroy digital coins, even if it proved highly damaging.

How Does a 51% Attack Work?

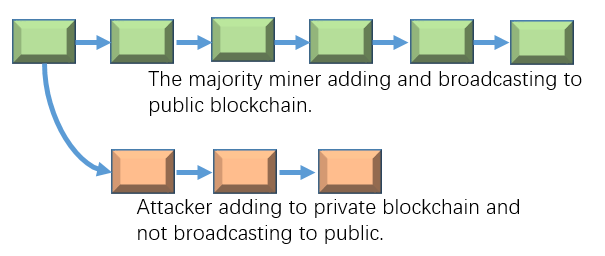

- Bitcoin and other cryptocurrencies are based on blockchains, and transactions are recorded on a distributed ledger, confirmed and arranged in blocks in chronological order by miners, to prevent the double-spending of cryptocurrencies. Take Bitcoin, for example, use the PoW consensus mechanism to solve the problem of how to obtain the right to record, and the "longest chain consensus" is used to solve the problem of how to record.

- As for 51% attack, the individual or group who have the advantage of computing can generate a longer chain to block other users' transactions, and send a transaction and then reverse it, base on the features of the PoW protocol of mining and longest proof-of-work chain consensus. "51%" means individual or group will occupy 51% of the whole blockchain computational power, who could attempt to select the current block and then begin mining and withholding the mined blocks. As a matter of fact, when a malicious attacker holds a relatively high percentage of computational power in the entire network, even if it has not reached 51%, it can still create an attack, which is generally the double-spending problem.

- Take a virtual example, Let's assume that an attacker A has 51% of the computational power, at the block height of 1000, A transferred 10 Bitcoins to B, the record of a Bitcoin transferred is packaged by the miner. After the transaction is confirmed, A regenerates a "longer chain" after the block height of 999 by relying on 51% of the computational power advantage, then transfers the Bitcoin to C at the block height of 1000, and the transaction record is packaged, which means the chain contains the record of A transferring a bitcoin to C. According to the "Longest Chain Consensus", the chain containing the transfer record to C becomes the main chain, and a bitcoin transferred from A to B is an "invalid payment". As a result, attacker A has spent the coins twice.

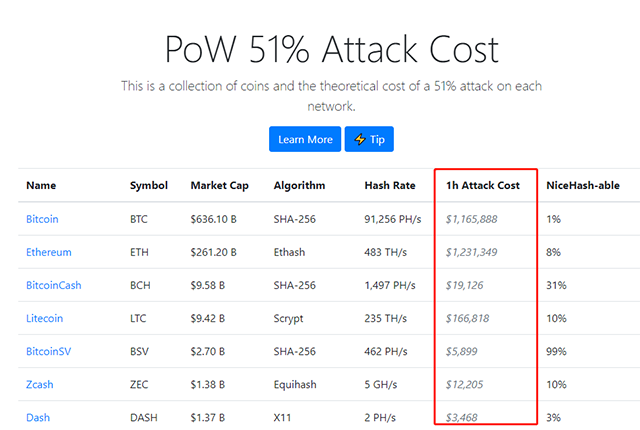

How Much Would it Cost to 51% Attack Bitcoin?

- As for Bitcoin, changing historical blocks—transactions locked in before the start of the attack—would be extremely difficult even in the event of a 51% attack. The further back the transactions are, the more difficult it would be to change them. It would be impossible to change transactions before a checkpoint, past which transactions are hard-coded into bitcoin's software. On the other hand, a form of a 51% attack is possible with less than 50% of the network's mining power, but with a lower probability of success.

- In order to obtain 51% computational power, ASICs (mining hardware), power capacity, or controlling mining pools that have a combined majority of the synthetic hash rate are needed. Both ways cost a lot. With the current total network hashrate of 150 EH/s, to achieve this, we need the approximately 1.364M highest efficiency ASICs(110 TH/s,3250 W per unit), which will totally consume 4.4 GW of power. That means, with one unit price of $4000, only the hardware totally would cost exceed $5.5 billion. Factoring in all the R&D costs to catch up to existing hardware manufacturers, plus all the other data center equipment needed, the true cost would likely be far higher. In conclusion, successfully attacking those would require too much computing power, and therefore prove too costly.

How Likely Are 51% Attacks?

- It's more difficult for an attack to happen on blockchain networks with a large number of participants, such a Bitcoin. Because their collective computational power is greater than what an individual or group working together can overcome.

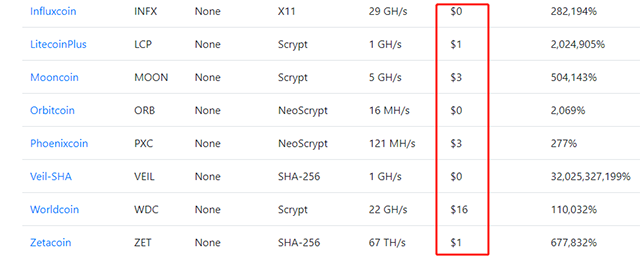

- However, smaller mining-based cryptocurrencies are more likely at risk of 51% attacks. If they use a well-established blockchain for their coins, a hacker only needs to know the algorithm it uses to understand how to attack it.

- In one month during 2018, there were five 51% attacks, all on relatively small blockchains, since small blockchains cost little, compare to large ones. As 51% attacks became more common, some people worried that larger networks might be at risk for them, as well.

- The website Crypto51 gives examples of how much it would cost to carry out a 51% attack on certain blockchains for one hour. The current rates topped out more than 1 million, but the costs plummeted to only a few dollars or less for smaller blockchains.

Does 51% Attack Happen in History?

- Krypton and Shift, which are cloned from the Ethereum blockchain, suffered 51% attacks from The 51 Crew in August 2016. The 51 Crew tampered with the blockchain's software code, which allowed them to double-spend the cryptocurrency. They also sent ransom notes to the affected parties.

- In May of 2018, Bitcoin Gold, at the time the 26th-largest cryptocurrency, suffered a 51% attack. The malicious actor or actors controlled a vast amount of Bitcoin Gold's hash power, such that even with Bitcoin Gold repeatedly attempting to raise the exchange thresholds, the attackers were able to double-spend for several days, eventually stealing more than $18 million worth of Bitcoin Gold.

- Firo coin suffers a 51% attack in 2021 on the 18th of January. Hackers tampered with previously confirmed transactions on the blockchain, affecting hundreds of blocks. After that, the price of Firo fell by more than 15%.

How to Prevent 51% Attack?

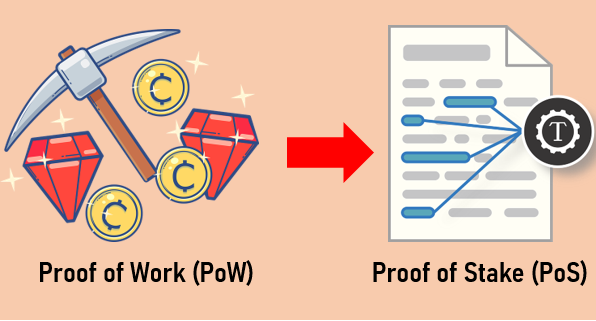

Although A 51% attack isn't a common phenomenon, it's not something that can be omitted. The risk associated with a 51% attack may be the devaluation of a particular digital currency, which cryptocurrency investors care about a lot. If a cryptocurrency suffers frequent block attacks, that could cause investors to lose confidence in the market and cause the price of the cryptocurrency to collapse. To prevent a 51% attack, one thing is allowing more miners to take part in, which will increase the decentralization, reduce the chance that individuals or groups that obtain exceed 51% computational power. Another way is Moving to the proof of stake (PoS) model, which allocates mining power to people depending on how many coins they hold.

Stay tuned to CoinCarp Social Media and Discuss with Us:

X (Twitter) | Telegram | Reddit

Download CoinCarp App Now: https://www.coincarp.com/app/

- Chainlink Poised for Breakout: Could LINK Break $46? Beginner 2m

- Venga Takes Proactive Steps Toward EU Compliance with MiCA Pre-Application Beginner 2m

- Singularity Finance Partners with Particle Network to Streamline Blockchain and AI Integration Beginner 2m

- Why Are Telegram Mini-Games The Key To Web3 Gaming Adoption? Beginner 5m