Fiat currencies

Crypto Currencies

What Is a Crypto Pump and Dump Scheme?

"Once you buy a crypto asset, it falls, however, if you sell, it rises." These are probably two mistakes that investors often make. So why does it happen? Generally speaking, the crypto market is relatively new, as well as blockchain technology, it is easier to issue a token or coin than issue securities on the traditional stock market. In this case, the crypto world is a place that lacks regulations and attracts big whales to use different schemes to manipulate the market. Some tactics are immoral or even illegal. One of the schemes is the pump and dump scheme.

What Is a Pump and Dump Scheme in Crypto World?

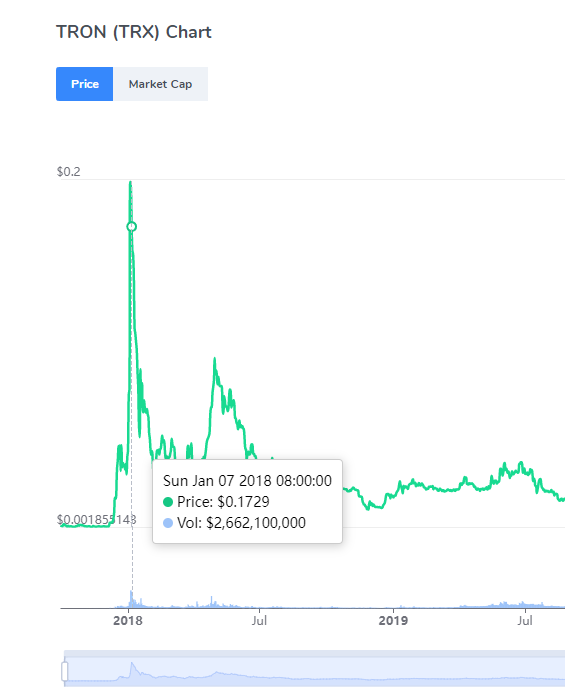

The pump and dump scheme in the crypto world is similar to the stock market. The theory is quite simple. An investor or a group of investors purchase a thinly traded crypto asset when the price is quite low. Then they will spread the positive false news of the target crypto asset to the public to attract retail investors to purchase. The more retail investors rush to the target crypto asset, the price will continue to go upward. This process is called "Pump". When the price is reaching the target price, they will suddenly "dump" all the shares to the buyers who still coming in to "smash the market". Because they hold a large share, the price will crash. This kind of smashing without warning will make many retail investors lose heavily, however, those who use the pump and dump scheme investors have already doubled the investment by selling their shares. In crypto world, with the spread fast feature of the Internet Social Networks, the price of one crypto may pump and dump in less than 10 minutes. The famous case is TRON, it increased 100x, then went down.

How Does a Pump-and-Dump Work in Cryptocurrency?

A pump-and-dump in cryptocurrency theory is simple. It is based on the basic supply and demands economic theory and the greedy mentality of investors. In general, the procedure is as follow:

- Target a crypto asset with low volume. Market manipulators need to find a thinly traded crypto asset because it's more likely to react favorably while volumes go up. In general, the crypto asset issued through initial coin offerings (ICOs) can be the perfect target crypto. Moreover, they tend to target the crypto with a relatively stable price( to reduce the risk, if the pump is not working). However, it is much more simple nowadays. They don't even need to search for a crypto asset, they may just create a new altcoin.

- Start to buy the crypto asset slowly. Generally, when the token or coin is first listed on the exchange, the market manipulators will not start to purchase but just observe the market reaction. Once the short-term investors are out from the market, they will start to buy in slowly, it may keep on days or even weeks, ensuring the price is stable.

- Using the social network to release positive news to pump. The market manipulators will use social networks, such as Telegram, Discord, or other chat groups, to suggest the group members join in the "pump", encourage members to buy and hold the crypto assets. Because of the misinformation and upward price, more and more traders get in, making the price rise even faster.

- While the price is high enough, start to sell the holding assets to the retail investors. Market manipulators start to off-load their holdings, making large amounts of gains in the process. As time goes by, the price crash, leaving the retail investors who get in late stuck with the worthless crypto asset without buyers.

Nowadays, the Pump-and-Dump is always planned by teams. They found a group and call out members to pump, when reach the target price, they dump. Also, some "key opinion leaders" will use their information to pump a cryptocurrency. For example, John McAfee used his Twitter account to make over $13 million in various pump and dump schemes.

Is Pump and Dump Scheme Illegal in Crypto?

The pump and dump scheme is illegal in the stock market. However, cryptocurrency is another thing. Different countries have different regulations towards cryptocurrency, most of the county don't classify cryptocurrency as securities, so the law can not applicate to the pump and dump scheme in crypto. Some countries may consider the pump and dump scheme as online fraud, but it is not easy to track, and the lawsuit may take years.

To the Moon! How do You Spot a Pump and Dump Crypto?

Today, many market manipulators are eager to get profit in a short time and usually without patience. In this case, we can detect some pump and dump scheme traces, such as abnormal data exposed by exchanges, team founders' selling records are exposed on the Internet, etc.

The common way to identify a pump-and-dump crypto is when an unknown token price rises without any reason. It can be seen on the price chart easily.

- If you want to spot a pump and dump crypto in advance, you can try to track the small cap unknown token. Then find out if the surge social media activities on the project and people bragging in social media, such as Twitter, Telegram, etc. You may make a judgment that the crypto is in the period of pumping.

- If you find one cryptocurrency that large deposits to the exchanges' wallet, the market manipulators may plan to off-load their holdings.

Assuming you are in the right time of the pump and dump trade, definitely you can get profit. However, if your timing is wrong, then you may get stuck. So spotting a pump and dump is not easy and most of the time can be risky.

Stay tuned to CoinCarp Social Media and Discuss with Us:

X (Twitter) | Telegram | Reddit

Download CoinCarp App Now: https://www.coincarp.com/app/

- Flare Hackathon Highlights Verifiable AI Innovations with Google Cloud Confidential Space Beginner Mar 19, 2025 2m

- Bybit celebrates 1.5 million crypto cards issued, announces new features at Dubai event Beginner Mar 13, 2025 2m

- Etherlink launches Calypso upgrade to boost dApp development on Tezos L2 Beginner Mar 12, 2025 2m

- Crypto Portfolio Rebalancing Made Easy Using AI-Powered Agents Beginner Mar 12, 2025 3m