Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

What Is an Exchange's Pre-Market?

What Is Pre-Market?

Pre-market trading refers to the activity of buying and selling cryptocurrencies on an exchange before the regular trading session officially starts. This early window of trading can significantly influence market sentiment and provide valuable insights into the potential direction of the market once the regular session begins. Pre-market trading is particularly popular among professional traders and institutional investors who seek to react to news and events that occur outside of standard market hours. This comprehensive guide will explore the concept of pre-market trading, its significance, and how it works on major cryptocurrency exchanges.

What Is Pre-Market Trading?

Pre-market trading occurs in a designated time slot before the official market opening. In traditional finance, this period typically starts several hours before the regular trading session. The primary purpose of pre-market trading is to allow investors to respond to overnight news, earnings reports, economic data releases, and geopolitical events that might affect the market.

How Pre-Market Works?

During the pre-market session, traders can place orders to buy or sell securities. These orders are executed based on supply and demand, just like during regular trading hours. However, the volume of trades and liquidity may be lower in the pre-market, which can lead to increased volatility and wider bid-ask spreads.

Significance of Pre-Market Trading

- Market Sentiment: Pre-market trading provides a preview of how the market might perform during the regular session. Significant price movements in the pre-market can set the tone for the day's trading.

- Immediate Reactions: Investors can react quickly to news and events that occur outside regular trading hours, allowing them to take advantage of opportunities or mitigate risks.

- Price Discovery: The pre-market session contributes to the price discovery process by allowing traders to express their views on the value of securities based on new information.

Pre-Market Trading on Cryptocurrency Exchanges

Cryptocurrency exchanges operate 24/7, unlike traditional stock exchanges with fixed trading hours. However, some platforms have adopted the concept of pre-market trading to allow users to engage in early trading activities and respond to market-moving events.

What Are the Top Crypto Pre-Market Exchanges?

Here are some of the top cryptocurrency exchanges that offer pre-market trading:

- Binance: Known for its extensive range of cryptocurrencies and high trading volume, Binance also offers pre-market trading for new tokens before their official launch.

- KuCoin: This exchange provides a dedicated pre-market platform for trading new tokens, allowing buyers and sellers to set price quotes and match trades in advance.

- Coinbase: While primarily known for its spot trading, Coinbase also offers pre-market trading opportunities for certain tokens.

- OKX: Another major player in the crypto space, OKX offers pre-market trading for new tokens, ensuring liquidity and favorable prices.

These exchanges allow traders to get ahead of the market by trading new tokens before they become available to the general public. This can be an advantage for those looking to secure their desired prices and liquidity early on.

How to Use Pre-Market? Take Binance for Example

Using Binance's pre-market trading is a great way to get ahead of the curve with new tokens. Here's a step-by-step guide to help you get started:

Step-by-Step Guide to Using Binance Pre-Market

- Log into Your Binance Account. First, log into your Binance account. If you don’t have one, you’ll need to create an account and verify your identity.

- Navigate to the Spot Trading Page. Once logged in, go to the [Trade] section and select [Spot]. This will take you to the spot trading page where you can start your pre-market trades.

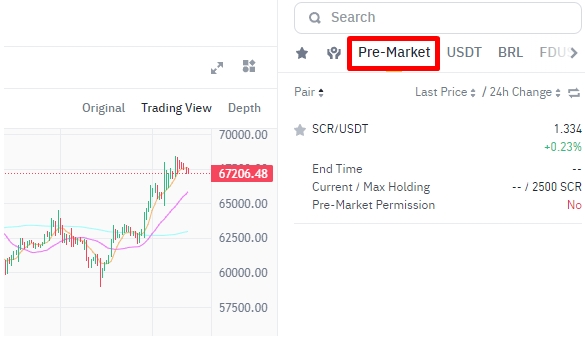

- Select Pre-Market Pairs. On the spot trading page, look for the category labeled "Pre-Market" or similar. This is where you’ll find the tokens available for pre-market trading.

- Start Trading. Select the token pair you want to trade and start your pre-market trades. You can place buy or sell orders just like you would in the regular spot market.

- Monitor Your Trades. Keep an eye on your trades and the market movements. Pre-market trading can be volatile, so it’s important to stay informed and make adjustments as needed.

- Complete Your Trades. Once the token is officially listed on the Binance Spot Market, your pre-market trades will be completed, and you can manage your holdings as usual.

Conclusion

Pre-market trading plays a crucial role in the financial markets, providing traders with early access to market opportunities and enabling them to respond to news and events before the regular trading session.

Stay tuned to CoinCarp Social Media and Discuss with Us:

X (Twitter) | Telegram | Reddit

Download CoinCarp App Now: https://www.coincarp.com/app/

Up to $6,045 Bonuses

Sponsored

Join Bybit and receive up to $6,045 in Bonuses! Register Now!