Tiền pháp định

Các loại tiền điện tử

Không có kết quả cho ""

Chúng tôi không thể tìm thấy bất cứ thứ gì trùng khớp với tìm kiếm của bạn.Hãy thử lại bằng một cụm từ khác.

Stablecoin Depegs: Why They Happen and What to Do About Them?

Stablecoins are a type of cryptocurrency that aim to provide a stable value relative to another asset, such as the US dollar, the euro, or gold. Unlike other cryptocurrencies, which can experience high volatility and price fluctuations, stablecoins are designed to offer a more predictable and reliable store of value and medium of exchange. Stablecoins can be used for various purposes, such as remittances, payments, trading, lending, and hedging.

However, stablecoins are not without challenges and risks. One of the most significant risks is the potential for a stablecoin to lose its peg, or its value relative to the underlying asset. This can happen for various reasons, such as market conditions, liquidity issues, regulatory changes, or design flaws. When a stablecoin depegs, it can cause significant losses for users, damage the reputation of the stablecoin issuer, and undermine the confidence in the stablecoin ecosystem.

In this article, we will explore the causes and mechanisms behind stablecoin depegs, as well as some historical examples and possible solutions. We will also discuss the implications and challenges of stablecoin regulation and oversight, as well as the future prospects and innovations in the stablecoin space.

How do stablecoins maintain their peg?

Stablecoins can be broadly classified into two categories: collateralized and non-collateralized. Collateralized stablecoins are backed by another asset, such as fiat currency, cryptocurrency, or commodity, that is held in reserve by the stablecoin issuer or a third-party custodian. Non-collateralized stablecoins are not backed by any asset, but rather rely on algorithms and smart contracts to adjust the supply and demand of the stablecoin to maintain its peg.

Collateralized stablecoins

Collateralized stablecoins can be further divided into three subcategories: fiat-collateralized, crypto-collateralized, and commodity-collateralized.

Fiat-collateralized stablecoins

Fiat-collateralized stablecoins are the most common and straightforward type of stablecoins. They are backed by a fiat currency, such as the US dollar, the euro, or the yen, at a 1:1 ratio. This means that for every stablecoin issued, there is an equivalent amount of fiat currency held in reserve by the stablecoin issuer or a third-party custodian. Users can redeem their stablecoins for the underlying fiat currency at any time, and vice versa.

Fiat-collateralized stablecoins are supposed to maintain their peg by ensuring that the supply and demand of the stablecoin are balanced. If the demand for the stablecoin exceeds the supply, the stablecoin issuer can mint more stablecoins and sell them in the market, increasing the supply and lowering the price. Conversely, if the supply of the stablecoin exceeds the demand, the stablecoin issuer can buy back the stablecoins and burn them, reducing the supply and increasing the price.

Some examples of fiat-collateralized stablecoins are Tether (USDT), USD Coin (USDC), TrueUSD (TUSD), and Paxos Standard (PAX). These stablecoins are pegged to the US dollar, and claim to be fully backed by cash and short-term securities held in reserve. However, some of these stablecoins have faced scrutiny and controversy over their reserve claims, transparency, and auditability.

Crypto-collateralized stablecoins

Crypto-collateralized stablecoins are backed by another cryptocurrency, such as Bitcoin, Ether, or a basket of cryptocurrencies, that is held in reserve by the stablecoin issuer or a smart contract. Unlike fiat-collateralized stablecoins, which are centralized and require trust in the issuer or the custodian, crypto-collateralized stablecoins are decentralized and trustless, as the reserves are verifiable on the blockchain.

However, crypto-collateralized stablecoins also face a major challenge: the volatility of the underlying cryptocurrency. Since cryptocurrencies are prone to large and sudden price movements, the value of the collateral can fluctuate significantly, threatening the stability of the stablecoin. To mitigate this risk, crypto-collateralized stablecoins are usually overcollateralized, meaning that more cryptocurrency is held as collateral than the value of the stablecoin. This provides a buffer against potential price drops of the collateral. For example, if a stablecoin is backed by 150% of Ether, a 33% drop in the price of Ether would still leave enough collateral to cover the value of the stablecoin.

Some examples of crypto-collateralized stablecoins are Dai (DAI), sUSD (SUSD), and BitUSD (BITUSD). These stablecoins are pegged to the US dollar, and are backed by various cryptocurrencies, such as Ether, Synthetix Network Token (SNX), and BitShares (BTS), respectively. These stablecoins use smart contracts and algorithms to automatically adjust the collateral ratio and the supply and demand of the stablecoin to maintain the peg.

Commodity-collateralized stablecoins

Commodity-collateralized stablecoins are backed by a commodity, such as gold, silver, or oil, that is held in reserve by the stablecoin issuer or a third-party custodian. These stablecoins aim to provide a stable value that is linked to the price of the commodity, as well as exposure to the commodity market. Commodity-collateralized stablecoins can also serve as a hedge against inflation and currency devaluation, as commodities tend to retain their purchasing power over time.

Some examples of commodity-collateralized stablecoins are Paxos Gold (PAXG), Digix Gold Token (DGX), and Tether Gold (XAUT). These stablecoins are pegged to the price of gold, and claim to be fully backed by physical gold bars held in vaults. However, similar to fiat-collateralized stablecoins, these stablecoins also require trust in the issuer or the custodian, as well as regular audits and verification of the reserves.

Non-collateralized stablecoins

Non-collateralized stablecoins are not backed by any asset, but rather rely on algorithms and smart contracts to adjust the supply and demand of the stablecoin to maintain its peg. These stablecoins are also known as algorithmic stablecoins or seigniorage stablecoins, as they mimic the function of a central bank that can issue or withdraw money from circulation to stabilize the currency.

Non-collateralized stablecoins use various mechanisms to regulate the supply and demand of the stablecoin, such as bonds, shares, oracles, and feedback loops. For example, if the demand for the stablecoin exceeds the supply, the algorithm can mint more stablecoins and distribute them to the holders of the shares, which are tokens that represent a claim on the future profits of the stablecoin. Conversely, if the supply of the stablecoin exceeds the demand, the algorithm can issue bonds, which are tokens that promise to pay back the stablecoin plus interest in the future, and sell them to the users who want to buy the stablecoin at a discount. This reduces the supply and increases the demand of the stablecoin, as well as creates an incentive for the bond holders to buy the stablecoin in the future.

Some examples of non-collateralized stablecoins are Basis Cash (BAC), Empty Set Dollar (ESD), and Frax (FRAX). These stablecoins are pegged to the US dollar, and use different algorithms and mechanisms to maintain their peg. However, non-collateralized stablecoins also face several challenges, such as the complexity and reliability of the algorithms, the accuracy and security of the oracles, and the scalability and sustainability of the system.

Why do stablecoins depeg?

Stablecoins can depeg from their pegged asset for various reasons, depending on the type and design of the stablecoin. Some of the common causes and mechanisms behind stablecoin depegs are:

Market conditions

Stablecoins are subject to market forces, such as supply and demand, speculation, arbitrage, and liquidity. These factors can affect the price and availability of the stablecoin, as well as the underlying asset or collateral. For example, if there is a sudden surge or drop in the demand for the stablecoin, the price of the stablecoin can deviate from its pegged value, creating an arbitrage opportunity for traders to buy or sell the stablecoin and the underlying asset or collateral, until the price returns to equilibrium. However, this process can be hindered by liquidity issues, such as the lack of trading volume, market depth, or exchange availability, which can prevent the efficient execution of the arbitrage trades and prolong the depegging event.

Liquidity issues

Liquidity issues can arise from various sources, such as technical glitches, network congestion, security breaches, or regulatory actions. These issues can affect the functionality and accessibility of the stablecoin, as well as the underlying asset or collateral. For example, if there is a technical problem or a security breach that affects the stablecoin issuer or the custodian, the users may not be able to redeem or deposit their stablecoins or the underlying asset or collateral, creating a mismatch between the supply and demand of the stablecoin and the underlying asset or collateral. This can cause the price of the stablecoin to deviate from its pegged value, as well as create uncertainty and panic among the users.

Regulatory changes

Regulatory changes can also affect the stability and viability of the stablecoin, as well as the underlying asset or collateral. For example, if there is a change in the legal status or the tax treatment of the stablecoin or the underlying asset or collateral, the users may face legal or financial risks or obligations, which can affect their demand and preference for the stablecoin or the underlying asset or collateral. This can cause the price of the stablecoin to deviate from its pegged value, as well as create confusion and distrust among the users.

Design

Design flaws can also affect the stability and performance of the stablecoin, as well as the underlying asset or collateral. For example, if there is a bug or a vulnerability in the code or the algorithm of the stablecoin or the smart contract, the stablecoin may not function as intended, or may be exploited by malicious actors, resulting in a loss of funds, a breach of trust, or a depegging event. Additionally, if there is a flaw or a limitation in the design or the mechanism of the stablecoin, such as the collateral ratio, the redemption process, or the governance model, the stablecoin may not be able to cope with the changing market conditions, user behaviors, or external shocks, leading to a depegging event.

What are some historical examples of stablecoin depegs?

Stablecoin depegs have occurred several times in the history of the stablecoin space, affecting various types of stablecoins and causing various impacts and consequences. Some of the notable examples of stablecoin depegs are:

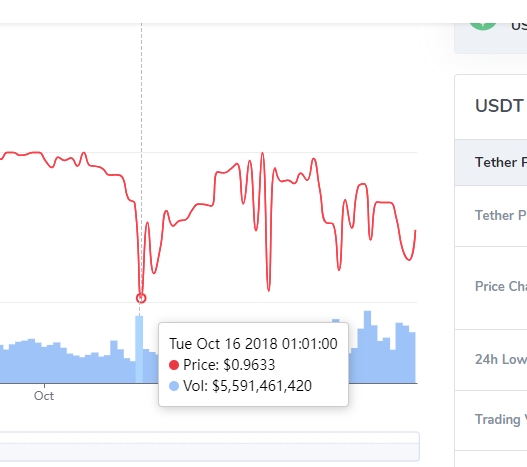

Tether (USDT) is the oldest and the most widely used fiat-collateralized stablecoin, pegged to the US dollar. However, Tether has also faced several controversies and challenges over its reserve claims, transparency, and auditability, as well as legal and regulatory issues. These issues have caused Tether to depeg from its pegged value several times, sometimes significantly and persistently.

One of the most prominent examples of Tether depegging occurred in October 2018, when Tether lost its peg and traded as low as $0.85 on some exchanges, amid rumors of insolvency, banking issues, and market manipulation. The depegging event also affected the price of Bitcoin and other cryptocurrencies, as many traders used Tether as a proxy for the US dollar and a hedge against volatility. The depegging event lasted for several days, until Tether restored its peg and regained its market share.

Another example of Tether depegging occurred in April 2019, when Tether lost its peg and traded as high as $1.05 on some exchanges, amid revelations that Tether was only 74% backed by cash and equivalents, and that Tether and its affiliated exchange Bitfinex were under investigation by the New York Attorney General for allegedly covering up a $850 million loss of customer funds. The depegging event also affected the price of Bitcoin and other cryptocurrencies, as many traders used Tether as a means of arbitrage and leverage. The depegging event lasted for several hours, until Tether returned to its peg and stabilized its market share.

Dai (DAI) is the most popular and the most decentralized crypto-collateralized stablecoin, pegged to the US dollar. However, Dai has also faced several challenges and risks over its collateralization, scalability, and governance, as well as technical and market shocks. These shocks have caused Dai to depeg from its pegged value several times, sometimes mildly and temporarily, sometimes severely and permanently.

One of the most severe examples of Dai depegging occurred in March 2020, when Dai lost its peg and traded as high as $1.10 on some exchanges, amid a massive crash in the cryptocurrency market, which triggered a cascade of liquidations and auctions of the collateral backing Dai. The depegging event also exposed a critical vulnerability in the Maker protocol, which allowed some bidders to win the auctions for zero Dai, resulting in a loss of $6.65 million worth of Ether. The depegging event lasted for several days, until the Maker community implemented several emergency measures, such as increasing the stability fee, lowering the debt ceiling, adding new collateral types, and conducting a debt auction. The depegging event also led to the creation of a new version of Dai, called Multi-Collateral Dai (MCD), which replaced the original Single-Collateral Dai (SCD).

Another example of Dai depegging occurred in May 2021, when Dai lost its peg and traded as low as $0.95 on some exchanges, amid a surge in the demand for Dai, driven by the growth of the decentralized finance (DeFi) sector, which offered high yields and incentives for Dai users. The depegging event also revealed a limitation in the Maker protocol, which relied on a fixed supply of Dai, rather than a dynamic supply that could adjust to the market demand. The depegging event lasted for several weeks, until the Maker community implemented several solutions, such as increasing the debt ceiling, lowering the stability fee, adding new collateral types, and introducing a new mechanism called the Peg Stability Module (PSM), which allowed users to swap Dai and USDC at a fixed rate.

Basis Cash (BAC)

Basis Cash (BAC) is one of the most ambitious and the most experimental non-collateralized stablecoins, pegged to the US dollar. However, Basis Cash has also faced several difficulties and uncertainties over its algorithm, its mechanism, and its adoption, as well as market and regulatory pressures. These pressures have caused Basis Cash to depeg from its pegged value several times, sometimes moderately and briefly, sometimes drastically and indefinitely.

One of the most drastic examples of Basis Cash depegging occurred in December 2020, when Basis Cash lost its peg and traded as low as $0.15 on some exchanges, amid a collapse in the demand for Basis Cash, caused by a lack of liquidity, a lack of incentives, and a lack of confidence. The depegging event also exposed a flaw in the Basis Cash protocol, which allowed the supply of Basis Cash to increase indefinitely, without any limit or feedback loop, creating a vicious cycle of inflation and devaluation. The depegging event lasted for several months, until the Basis Cash community implemented several changes, such as introducing a new token called Basis Share (BAS), which replaced the original Basis Bond (BAB), and adding a new mechanism called the Boardroom, which allowed users to stake their Basis Share and earn Basis Cash rewards.

Another example of Basis Cash depegging occurred in June 2021, when Basis Cash lost its peg and traded as high as $1.50 on some exchanges, amid a spike in the demand for Basis Cash, driven by a new partnership with a DeFi platform called Convex Finance, which offered high returns and rewards for Basis Cash users. The depegging event also revealed a limitation in the Basis Cash protocol, which relied on a fixed interest rate for the Basis Bond, rather than a variable interest rate that could adjust to the market demand. The depegging event lasted for several days, until the Basis Cash community implemented several adjustments, such as increasing the interest rate, lowering the debt ceiling, and adding new collateral types.

What are some possible solutions to prevent or mitigate stablecoin depegs?

Stablecoin depegs are inevitable and unavoidable, as no stablecoin can guarantee perfect stability and performance under all circumstances and scenarios. However, stablecoin depegs can be prevented or mitigated by various measures and strategies, depending on the type and design of the stablecoin. Some of the possible solutions to prevent or mitigate stablecoin depegs are:

Collateralization

Collateralization is the most fundamental and the most effective way to ensure the stability and the solvency of the stablecoin, as well as the confidence and the trust of the users. Collateralization can be achieved by various means, such as increasing the amount, the quality, or the diversity of the collateral, as well as improving the transparency, the auditability, or the security of the collateral. Collateralization can also be enhanced by using multiple layers or types of collateral, such as fiat, crypto, or commodity, as well as using hybrid or fractional models, such as partially collateralized or algorithmically collateralized stablecoins.

Liquidity

Liquidity is another crucial and another beneficial way to ensure the stability and the efficiency of the stablecoin, as well as the functionality and the accessibility of the stablecoin. Liquidity can be achieved by various means, such as increasing the volume, the depth, or the availability of the stablecoin, as well as improving the interoperability, the compatibility, or the integration of the stablecoin. Liquidity can also be enhanced by using multiple platforms or channels for the stablecoin, such as centralized or decentralized exchanges, wallets, or protocols, as well as using cross-chain or layer-2 solutions, such as bridges, sidechains, or rollups.

Governance

Governance is another important and another beneficial way to ensure the stability and the adaptability of the stablecoin, as well as the participation and the satisfaction of the users. Governance can be achieved by various means, such as increasing the decentralization, the democracy, or the diversity of the stablecoin, as well as improving the transparency, the accountability, or the security of the stablecoin. Governance can also be enhanced by using multiple models or mechanisms for the stablecoin, such as on-chain or off-chain governance, voting or delegation, or incentives or penalties.

What are the implications and challenges of stablecoin regulation and oversight?

Stablecoin regulation and oversight are inevitable and unavoidable, as stablecoins pose various risks and challenges to the financial system, the monetary policy, and the consumer protection. Stablecoin regulation and oversight can have various implications and challenges for the stablecoin space, depending on the jurisdiction, the authority, and the approach of the regulators and the overseers. Some of the implications and challenges of stablecoin regulation and oversight are:

Compliance

Compliance is the most immediate and the most significant implication and challenge of stablecoin regulation and oversight, as stablecoins have to comply with various laws and regulations, such as anti-money laundering (AML), counter-terrorism financing (CTF), know your customer (KYC), tax, and securities laws. Compliance can have various costs and benefits for the stablecoin space, such as increasing the legitimacy

and credibility of the stablecoin space, as well as increasing the complexity and difficulty of the stablecoin space. Compliance can also have various impacts and consequences for the stablecoin space, such as affecting the stability and the performance of the stablecoin, as well as affecting the innovation and the competition of the stablecoin.

Supervision

Supervision is another important and another significant implication and challenge of stablecoin regulation and oversight, as stablecoins have to be supervised and monitored by various authorities and agencies, such as central banks, financial regulators, or law enforcement. Supervision can have various costs and benefits for the stablecoin space, such as increasing the security and the accountability of the stablecoin space, as well as increasing the interference and the control of the stablecoin space. Supervision can also have various impacts and consequences for the stablecoin space, such as affecting the privacy and the autonomy of the stablecoin, as well as affecting the scalability and the interoperability of the stablecoin.

Coordination

Coordination is another crucial and another significant implication and challenge of stablecoin regulation and oversight, as stablecoins have to coordinate and cooperate with various stakeholders and actors, such as governments, institutions, or organizations. Coordination can have various costs and benefits for the stablecoin space, such as increasing the collaboration and the integration of the stablecoin space, as well as increasing the fragmentation and the inconsistency of the stablecoin space. Coordination can also have various impacts and consequences for the stablecoin space, such as affecting the diversity and the inclusivity of the stablecoin, as well as affecting the innovation and the competition of the stablecoin.

What are the future prospects and innovations in the stablecoin space?

Stablecoin space is a dynamic and evolving space, as stablecoins face various opportunities and challenges, as well as various trends and developments. Stablecoin space can have various prospects and innovations in the future, depending on the vision, the ambition, and the creativity of the stablecoin creators and users. Some of the future prospects and innovations in the stablecoin space are:

Central bank digital currencies (CBDCs)

Central bank digital currencies (CBDCs) are a type of digital currency that are issued and regulated by a central bank, such as the Federal Reserve, the European Central Bank, or the People’s Bank of China. CBDCs aim to provide a digital alternative to cash and bank deposits, as well as a digital complement to existing payment systems and monetary policies. CBDCs can have various advantages and disadvantages, such as increasing the efficiency and the security of the financial system, as well as increasing the surveillance and the influence of the central bank.

CBDCs can also have various implications and challenges for the stablecoin space, such as competing or collaborating with the stablecoin space, as well as regulating or supporting the stablecoin space. CBDCs can also have various impacts and consequences for the stablecoin space, such as affecting the demand and the preference for the stablecoin, as well as affecting the innovation and the competition of the stablecoin.

Decentralized finance (DeFi)

Decentralized finance (DeFi) is a type of finance that is powered by blockchain technology and smart contracts, without the need for intermediaries or centralized authorities. DeFi aims to provide a more open, transparent, and inclusive financial system, as well as a more innovative, competitive, and efficient financial system. DeFi can offer various services and products, such as lending, borrowing, trading, investing, or saving.

DeFi can also have various implications and challenges for the stablecoin space, such as integrating or disrupting the stablecoin space, as well as enhancing or endangering the stablecoin space. DeFi can also have various impacts and consequences for the stablecoin space, such as affecting the supply and the demand for the stablecoin, as well as affecting the stability and the performance of the stablecoin.

Algorithmic and synthetic stablecoins

Algorithmic and synthetic stablecoins are a type of stablecoin that are not backed by any asset, but rather rely on algorithms and smart contracts to adjust the supply and demand of the stablecoin to maintain its peg. Algorithmic and synthetic stablecoins aim to provide a more scalable, flexible, and autonomous stablecoin, as well as a more innovative, competitive, and efficient stablecoin. Algorithmic and synthetic stablecoins can offer various features and functions, such as governance, incentives, oracles, or feedback loops.

Algorithmic and synthetic stablecoins can also have various implications and challenges for the stablecoin space, such as complementing or replacing the stablecoin space, as well as improving or complicating the stablecoin space. Algorithmic and synthetic stablecoins can also have various impacts and consequences for the stablecoin space, such as affecting the diversity and the inclusivity of the stablecoin, as well as affecting the stability and the performance of the stablecoin.

Conclusion

Stablecoins are a type of cryptocurrency that aim to provide a stable value relative to another asset, such as the US dollar, the euro, or gold. Stablecoins can be used for various purposes, such as remittances, payments, trading, lending, and hedging. However, stablecoins are not without challenges and risks. One of the most significant risks is the potential for a stablecoin to lose its peg, or its value relative to the underlying asset. This can happen for various reasons, such as market conditions, liquidity issues, regulatory changes, or design flaws. When a stablecoin depegs, it can cause significant losses for users, damage the reputation of the stablecoin issuer, and undermine the confidence in the stablecoin ecosystem.

Stablecoins can be broadly classified into two categories: collateralized and non-collateralized. Collateralized stablecoins are backed by another asset, such as fiat currency, cryptocurrency, or commodity, that is held in reserve by the stablecoin issuer or a third-party custodian. Non-collateralized stablecoins are not backed by any asset, but rather rely on algorithms and smart contracts to adjust the supply and demand of the stablecoin to maintain its peg.

Stablecoins can depeg from their pegged asset for various reasons, depending on the type and design of the stablecoin. Some of the common causes and mechanisms behind stablecoin depegs are market conditions, liquidity issues, regulatory changes, and design flaws. Stablecoin depegs have occurred several times in the history of the stablecoin space, affecting various types of stablecoins and causing various impacts and consequences. Some of the notable examples of stablecoin depegs are Tether (USDT), Dai (DAI), and Basis Cash (BAC).

Stablecoin depegs can be prevented or mitigated by various measures and strategies, depending on the type and design of the stablecoin. Some of the possible solutions to prevent or mitigate stablecoin depegs are collateralization, liquidity, and governance.

Stablecoin regulation and oversight are inevitable and unavoidable, as stablecoins pose various risks and challenges to the financial system, the monetary policy, and the consumer protection. Stablecoin regulation and oversight can have various implications and challenges for the stablecoin space, such as compliance, supervision, and coordination.

Stablecoin space is a dynamic and evolving space, as stablecoins face various opportunities and challenges, as well as various trends and developments. Stablecoin space can have various prospects and innovations in the future, such as central bank digital currencies (CBDCs), decentralized finance (DeFi), and algorithmic and synthetic stablecoins.

Stay tuned to CoinCarp Social Media and Discuss with Us:

Up to $6,045 Bonuses

Sponsored

Join Bybit and receive up to $6,045 in Bonuses! Register Now!