Tiền pháp định

Các loại tiền điện tử

What are the Top 5 Yield Farming Projects in 2022?

DeFi projects have been developed for years, now there is about $70 billion worth of crypto locked in those programs. In these Defi programs, yield farming is a major way for you to get passive earning with crypto. (Click to learn more about Yield Farming). There are hundreds of projects that provide yield farming services with higher APR than a traditional bank. A bank may promise you 0.1%-0.3% for one year, however, yield farming can offer you up to 100% APY. In general, high profit comes with risk, which means the staking pool is riskier. This article will try to list the Top 5 yield farming projects with a high marketcap that you can get a good APY.

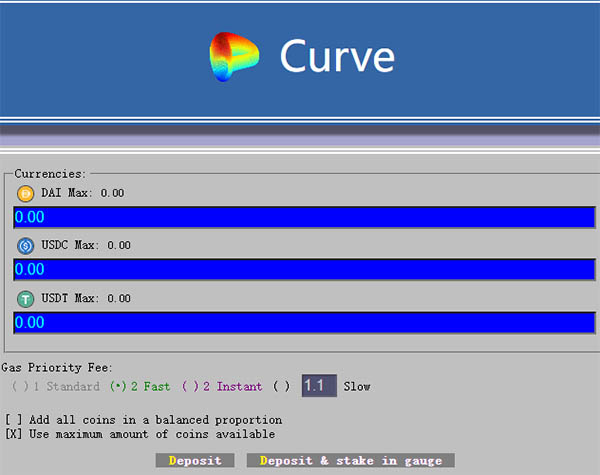

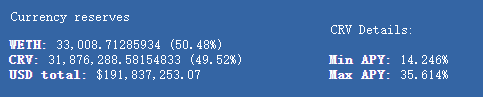

1. Curve Finance, Yield Farm to Get CRV Rewards, and up to 35% APR.

Curve is an exchange liquidity pool designed for stablecoin trading, rewards liquidity providers via the CRV token. They allow users to trade with various stable coins at a low rate. The platform uses AMM with the use of bonding curves and liquidity pools. Also, it supports muti-chains, such as Ethereum mainnet, Polygon, Fantom and xDai. The liquidity providers earn fees from the swap, so the listed APRs will fluctuate a lot based on volume and volatility. Besides the fees, Curve also rewards their native token $Curve to the providers. In order to provide liquidity, you will have to select one of the various Curve pools. The tokens eligible for deposit are listed below the pool. The APY's listed have various components to them. The "Base vAPY" is a number that changes daily depending on the trading activity in the pool. The "Rewards tAPY" is a number that has a range that tells you the CRV rewards you can earn from being in the pool. They maintain high APY, some pools may up to 35%. Because stable coin prices won't change dramatically, the impermanent loss can be completely avoided.

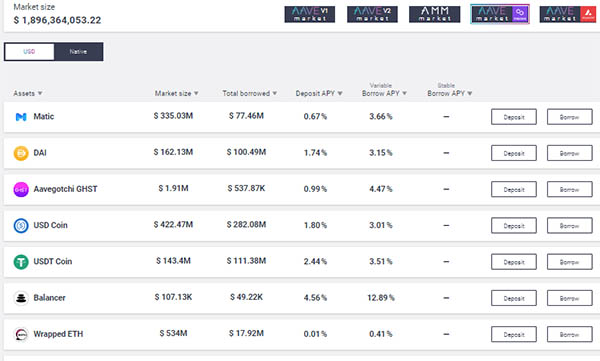

2. Aave (AAVE)-Earn from Loan Fee, up to 4% APY.

Aave is an open-source and non-custodial liquidity protocol for earning interest on deposits and borrowing assets. Depositors provide liquidity to the market to earn a passive income. Tokens holders receive continuous earnings from the interest rate payment on loan and Flash Loan fee. The way to start a yield farm on Aave is easy, browse to the "Deposit" section and click on "Deposit" for the asset you want to deposit. Select the amount you'd like to deposit and submit your transaction. Once the transaction is confirmed, your deposit is successfully registered and you begin earning interest.

3. Compound-Earning Interest with a variable interest rate, up to 3% APY

The Compound Protocol is a series of interest rate markets running on the Ethereum blockchain. When users and applications supply an asset to the Compound Protocol, they begin earning a variable interest rate instantly. Interest accrues every Ethereum block (currently ~13 seconds), and users can withdraw their principal plus interest anytime. Under the hood, users are contributing their assets to a large pool of liquidity (a "market") that is available for other users to borrow, and they share in the interest that borrowers pay back to the pool. Also, Compound rewards users for COMP tokens, which is a way to incentive the users. To use Compound, click "APP", choose the assets you would like to supply.

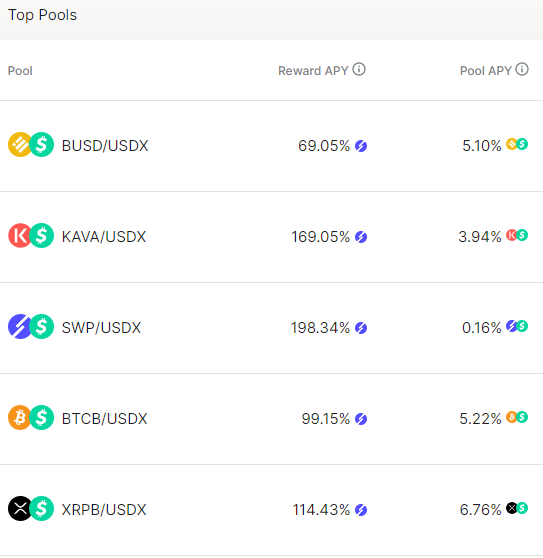

4. Kava-Supply Liquidity to Earn up to 6% APY and Extra Reward

Kava is a lightning-fast Layer-1 blockchain featuring a developer-optimized co-chain architecture that combines the two most used permissionless ecosystems - Ethereum and Cosmos - into a single, scalable, network. It encourages people to add liquidity to a pool and get passive earning. By clicking "Liquidity", users can choose coins from the "Select A Coin" dropdown menus and add liquidity to new or existing pools. Users can get interest and pool rewards, some pool rewards APY may up to 200%.

5. Balancer-Collect Fees from Traders, Up to 19% APR

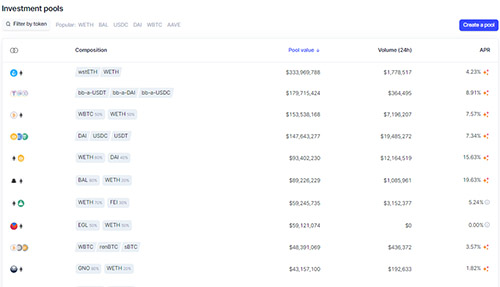

Balancer turns the concept of an index fund on its head: instead of paying fees to portfolio managers to rebalance your portfolio, you collect fees from traders who rebalance your portfolio by following arbitrage opportunities. Click "Launch app" on Balancer's official site and choose "Investment pools" to invest.

Why Yield Farming?

The projects listed above can ensure that the protocol itself runs normally to get income without setting up the "liquidity mining" mechanism, which can help the development of products.

However, because some DeFi protocols need to initialize liquidity in order to provide services with larger amounts of funds (and also serve more demanders), the "farming" mechanism will play an important role, it can allocate the potential benefits of the protocol in the future to early liquidity providers.

After users "farm" tokens, they can sell them immediately to increase their short-term income, or they can hold tokens to bind their long-term interests to the project and participate in the governance of the projects with developers and investors.

Conclusion

On the whole, Yield farming is a set of solutions that are worth keeping attention to, especially for DeFi projects that need initialized liquidity. However, questions such as the DeFi project is safe? Can I really earn from it? If you want to find out the questions, you'd better evaluate the business model and find out how does it work first.

Tìm chúng tôi trên:

X (Twitter) | Telegram | Reddit

Tải xuống ứng dụng CoinCarp ngay bây giờ: https://www.coincarp.com/app/

- Bybit Adds USDT0 Access to HyperEVM, Corn, and Berachain for Unified Stablecoin Transfers Sơ cấp Aug 04, 2025 2m

- Trading with 500x+ Leverage on MEXC: What You Should Know Sơ cấp Aug 01, 2025 5m

- Bitget Climbs to Top 3 in Global Derivatives Market, Bitcoin.com Report Finds Sơ cấp Jul 31, 2025 2m

- Bitget Introduces Rhea Finance (RHEA): Earn Rewards via CandyBomb and Community Campaign Sơ cấp Jul 31, 2025 2m